Market Review for October 2021

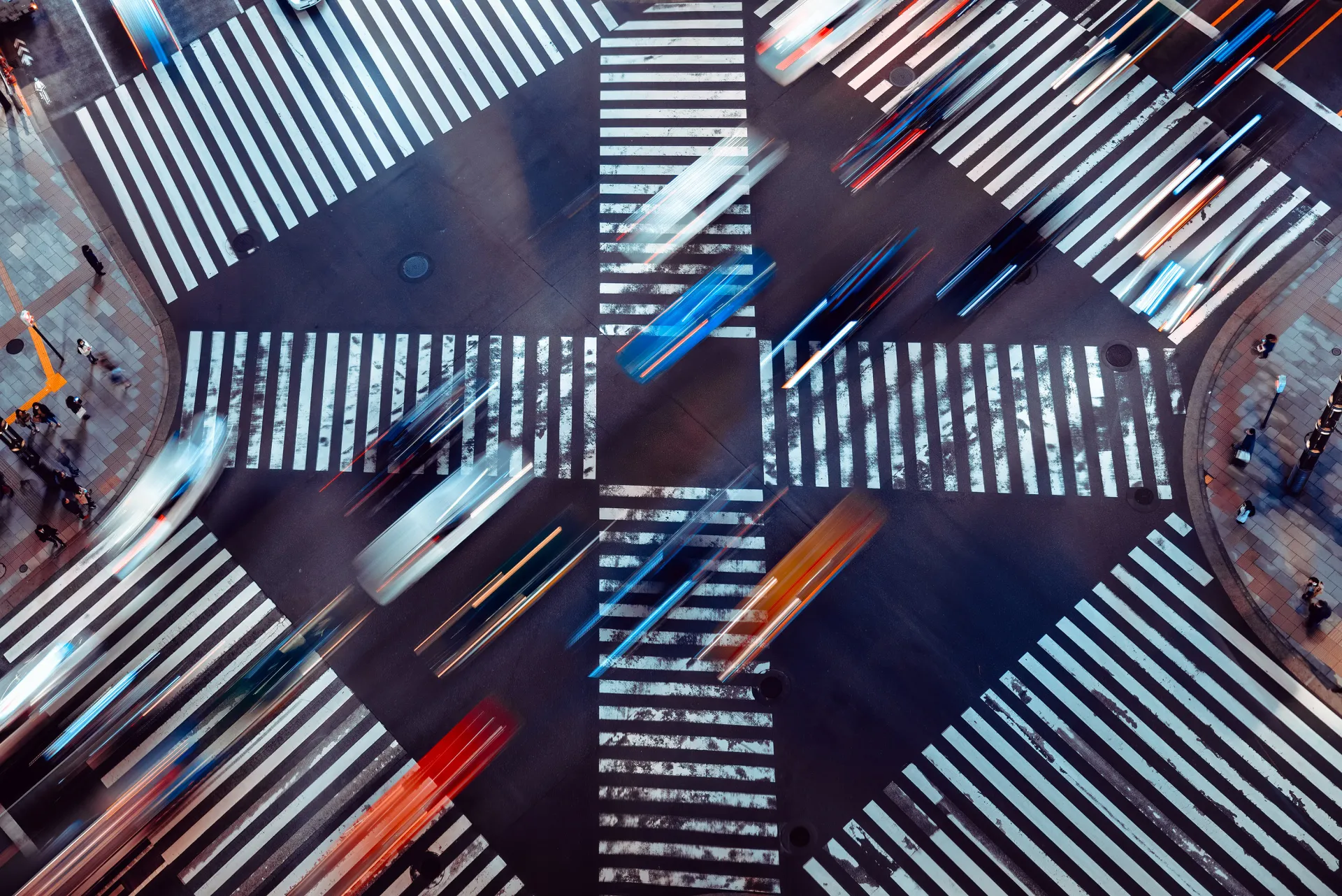

TOPIX ended down on the previous month-end. The Japanese equity market was dragged down by some concerns over global stagflation on rising commodity prices, an increase in US bond yield and default of the Chinese property giant, EVERGRANDE.