Yoshio Hishida’s 16 years as portfolio manager in global equities, coupled with his role as head of quantitative research, has stood him in good stead since taking over as chief executive officer in 2018. He says he never imagined himself as CEO, but feels his experience has given him the ability to “understand the business from the bottom up”.

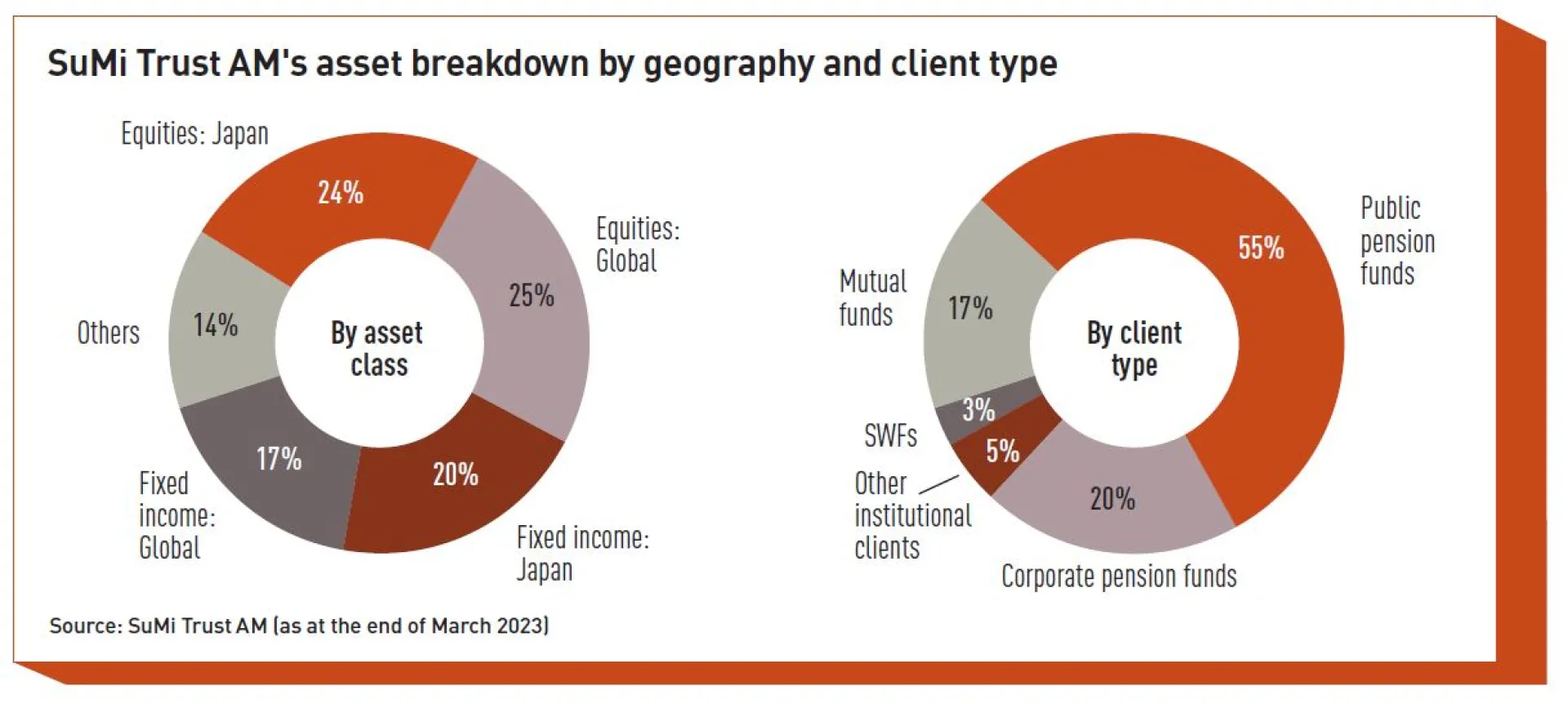

Now overseeing $607bn (€557bn) in assets under management, Hishida started his career at the Sumitomo Trust & Banking Corporation in 1986, rising up the ranks until being named president and CEO of SuMi TRUST AM five years ago.

Hishida also has a good overview of the Japanese investment industry. He is vice-chair of the country’s Securities Analysts Association and director of the Investment Trusts Association. SuMi TRUST was one of the original 51 signatories of the United Nations-supported Principles for Responsible Investment (PRI) and Hishida is also chair of a working group of the 30% Club, which promotes the need for gender diversity at board and executive committee level. He is keen to champion the cause of women in the workforce and says: “Diversity should be the core of business strategy; the promotion of women should be a fundamental reform, not a numerical adjustment.”

Hishida’s three priorities in the coming years include the expansion of the firm’s investment capabilities in Japan, diversifying away from traditional asset classes into alternatives; to grow its retail investor base; and to attract international capital.

Attracting international capital

We meet with Hishida on a global world tour as he targets foreign capital. “I believe Japan is particularly attractive at the moment, given the strong fundamentals of the Japanese economy and our relatively stable political situation. Add in the low inflation rate, and Japan’s uniqueness stands out amongst leading developed markets.”

He also points to the absence of significant commercial real estate debt and the associated banking crisis under way in the US, as well as to a particular reform angle – the efficiency drive Japanese companies are currently undertaking.

“We are likely to see a lot of changes in the corporate world in the next few years and this will offer investors significant opportunities,” Hishida says. “There are some 3,916 listed companies in Japan. Most are small and medium-size businesses that have traditionally been ignored by overseas investors, despite the fact that there are very good investment opportunities in them."

This could also mean opportunities in corporate bonds. “It has been very difficult over the last six years for investors to make money in the fixed-income markets, but we have succeeded in keeping our own fixed-income investment team together during this time. Now that the environment is changing, I believe they will have an opportunity to show their expertise in the future.”

Any new policy at the Bank of Japan (BoJ) is key. “It is very difficult to be sure what the BoJ will do. Originally, I thought they would move quickly but this hasn’t happened. I remain convinced that they will eventually change the model by which they have been managing the economy. But they will do this only very gradually as they seek to abandon yield-curve control and the previous negative interest rate policy.”

Hishida expects the yen will move in a range of 132 to 140 against the dollar until then. He is also hopeful that Japanese money will be repatriated to the country. “We have started to see this happen already as investors are returning to Japanese equities because they represent a strong investment opportunity.”

Moving into alternative assets

Hishida admits “our strength has always been in the traditional asset classes of equities and fixed income, but I believe that now is the time for us to expand into alternative assets. We are part of the wider SuMi TRUST Group and, as such, have access to the capabilities of affiliated companies.”

Sumitomo Mitsui Trust Bank has a team that handles private equity, and Sumitomo Mitsui Trust Real Estate Investment Management manages real estate investments. “So we already have a certain capability to deal with alternatives. We are starting to develop products for the private equity markets. People treat them as if they are very different, requiring very different skills and that is of course true to some extent. But I think we’re seeing a lot of traditional asset managers such as ourselves that are able to build on their expertise in traditional markets and to enter the private equity sphere.”

In seeking to build these capabilities Hishida intends to consider acquisitions, and joint ventures, as well as attracting talent through recruitment. He emphasises the infrastructure SuMi TRUST has created which allows fund managers to demonstrate their capabilities. “And our significant assets allow us to seed new products and to give a fund manager strong support. We have high-quality career development programmes within the company and have actively sought to create a supportive culture across the business. I would describe our environment as a ‘kindly one’.”

One aspect of this is SuMi TRUST’s attitude to hybrid working. “We adopted this during the pandemic but after consulting with the staff, it was clear that they wished us to keep this model. We have responded to their preferences. We do not dictate to our staff or force them to do anything. Rather we listen to them and respond accordingly.”

Retail investors

Currently, 80% of SuMi TRUST’s assets under management come from institutional investors, mainly in Japan. This has been the core of the business since the 1960s when Japanese corporate pension funds took off. But now, encouraging retail investment is very much top of the agenda for the Japanese government. From next April a new investment account is being introduced that is similar to the UK’s individual savings account (ISA).

In his position at the Investment Trusts Association, Hishida is seeking to take a leading role in driving this renaissance. “I believe the change next April will be the catalyst for significant growth in the retail investment market in Japan. During the period of low inflation most individuals tended to think very little about investment, but we will see this change.”

He is optimistic about the future. “I think this will be particularly true amongst the younger generation and that this will be a major opportunity for the asset management industry.”

Note: Re-produced with permission by IPE International Publishers, www.ipe.com