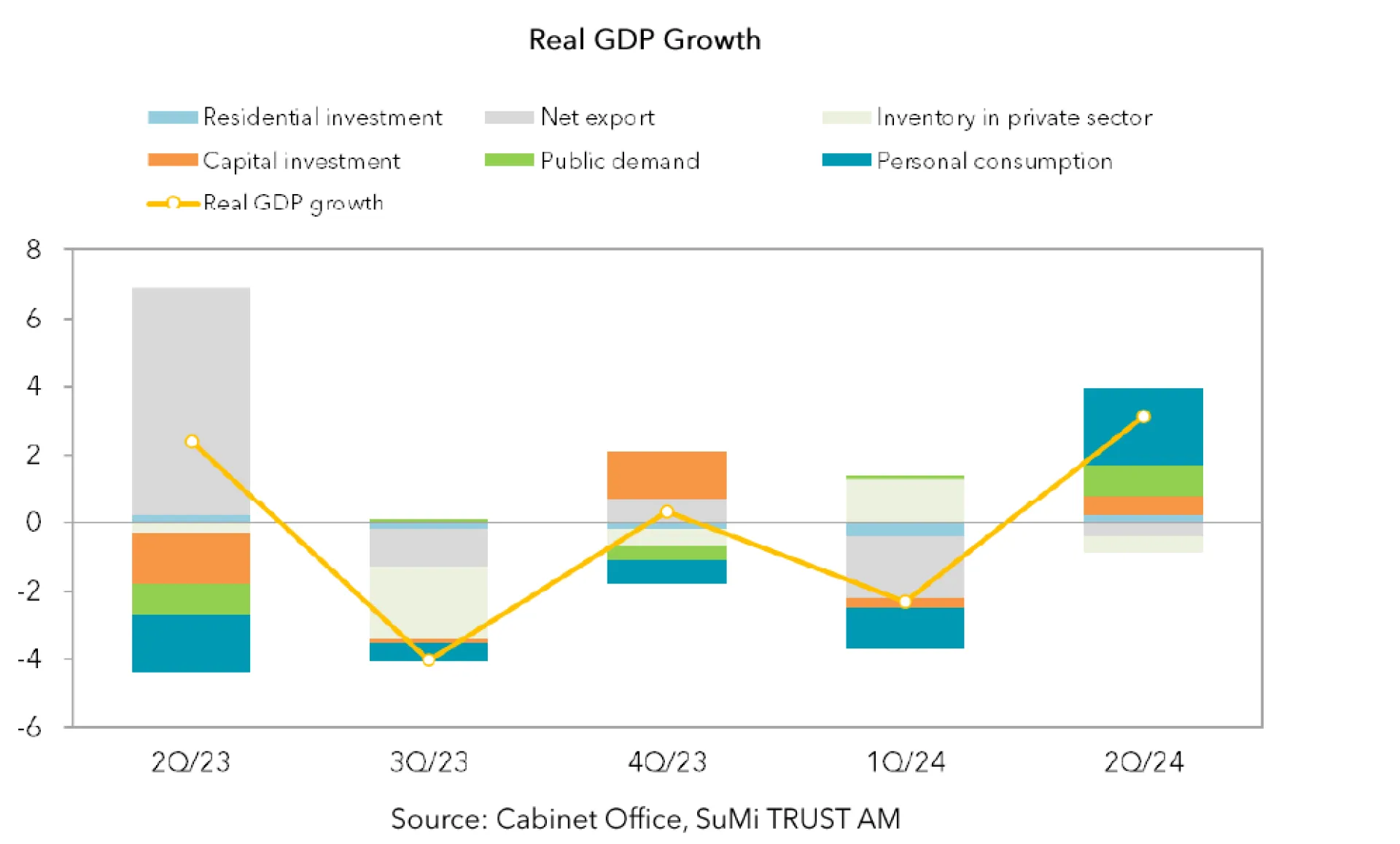

Personal consumption increased for the first time in five quarters

The preliminary report for Japan's real Gross Domestic Product (GDP) for Q2 2024, released on August 15, showed a quarter-on-quarter growth of +0.8% and an annualised rate of +3.1%. This was the first positive growth recorded in two quarters, exceeding the market forecast of +2.3%. A breakdown of the figures shows the contribution of domestic demand was +3.5% year-on-year (YoY) while foreign demand was -0.4% YoY, with the strength of domestic demand being the standout factor.

Personal consumption increased +1.0% quarter on quarter (QoQ), exceeding market expectations (+0.6% QoQ) and marking the first positive growth in five quarters. In addition to a recovery in durable goods thanks to an increase in automobile production, this growth was likely a spill over effect of the wage hikes achieved during spring wage negotiations. Capital investment was +0.9%, exceeding the market forecast of +0.8%.

Exports were +1.4% QoQ, the first positive growth in two quarters. The recovery in automobile production and the increase in consumption of foreign tourists visiting Japan have boosted exports. Imports were up 1.7% QoQ.

Market reaction and future points of interest

The Nikkei 225 started the day higher on August 15. In the U.S., the stock market was buoyed by the slowdown in the U.S. Consumer Price Index (CPI) and the upward swing in Japan's GDP for the April-June period.

The focus going forward will likely be whether personal consumption can maintain its upward momentum or not. The monthly labour statistics for June showed that real wages turned positive for the first time in two years and three months, and the 2025 spring labour offensive is already gearing up to start from October this year. The key points the market wants to confirm is whether large wage increases will continue and if the positive real wage situation is here to stay.

In addition, the Bank of Japan (BOJ) raised interest rates in July, and for the average household higher deposit rates will be a tailwind, while higher mortgage rates will be a headwind. It will be interesting to see how these changes will affect consumer spending.

Another point of interest is the presidential election of the Liberal Democratic Party (LDP), the current ruling party, scheduled for September. On August 14, Prime Minister Kishida announced his intention not to run in the election and is expected to step down as prime minister after a new president is elected. According to news reports, various candidates are being discussed. However, since it is unlikely that the victor of the election will make any major changes to the current economic policy, their influence on the stock market is likely to be limited for the time being.