1. Price Trends in Japan

Although the FOMC comments of November acknowledged increased uncertainty as "temporary“, there is growing concern that global inflation is not transient. Not only healthy price increases due to normalization of economic activities, but we have also had an increase in various commodity prices including crude oil, the temporary closure of production facilities due to the influence of COVID-19, and the disruption of the supply chain due to logistical issues. Concerns over bad price increases due to supply constraints are increasing day by day.

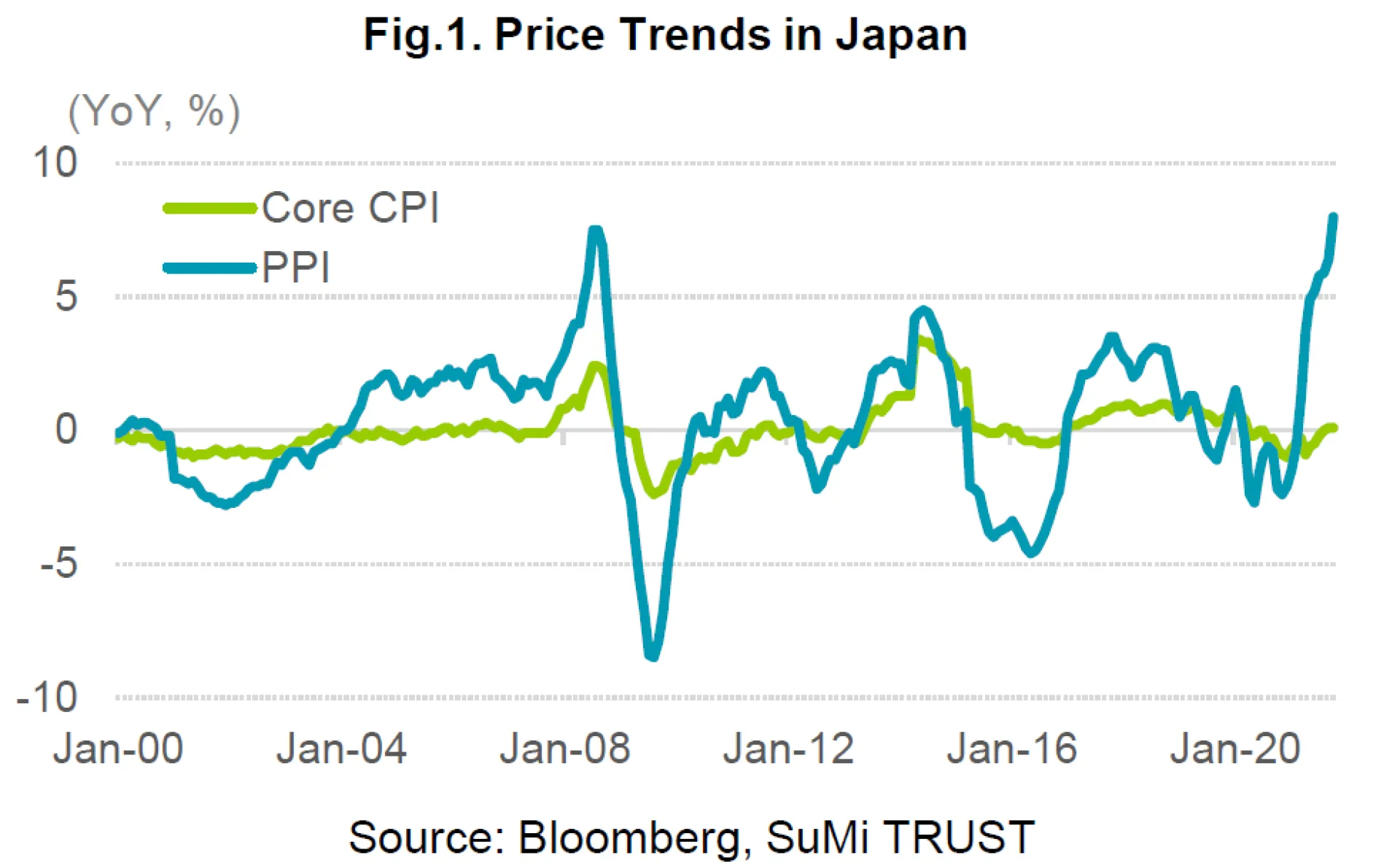

In Japan, we have also seen the price of goods traded between companies rise sharply, reflecting upward pressure on prices globally. The domestic corporate goods price index has continued to rise since the beginning of this year, reaching a year-on-year increase of 8.0% in October, the highest increase in the last 20 years (Figure 1). This reflects the impact of the rise in commodity prices, including crude oil prices, as well as supply constraints of components, mainly semiconductors, due to the impact of COVID-19 and higher costs due to logistical disruptions.

On the other hand, inflationary pressures from consumer goods and services are not exceedingly high in Japan. Core CPI (the comprehensive consumer price index excluding fresh food, see Figure 1) fell to -1.0% YoY as overall demand for goods and services declined due to the outbreak of COVID-19 toward the latter half of 2020, and due to the government's "Go To Travel" campaign, which brought down travel costs. But since then, rising energy prices have raised core CPI to +0.1% in September, the first positive figure since March 2020. Compared to the recent CPI of the United States and the United Kingdom of + 6.2% and + 3.1%, respectively, the situation is very different in Japan.

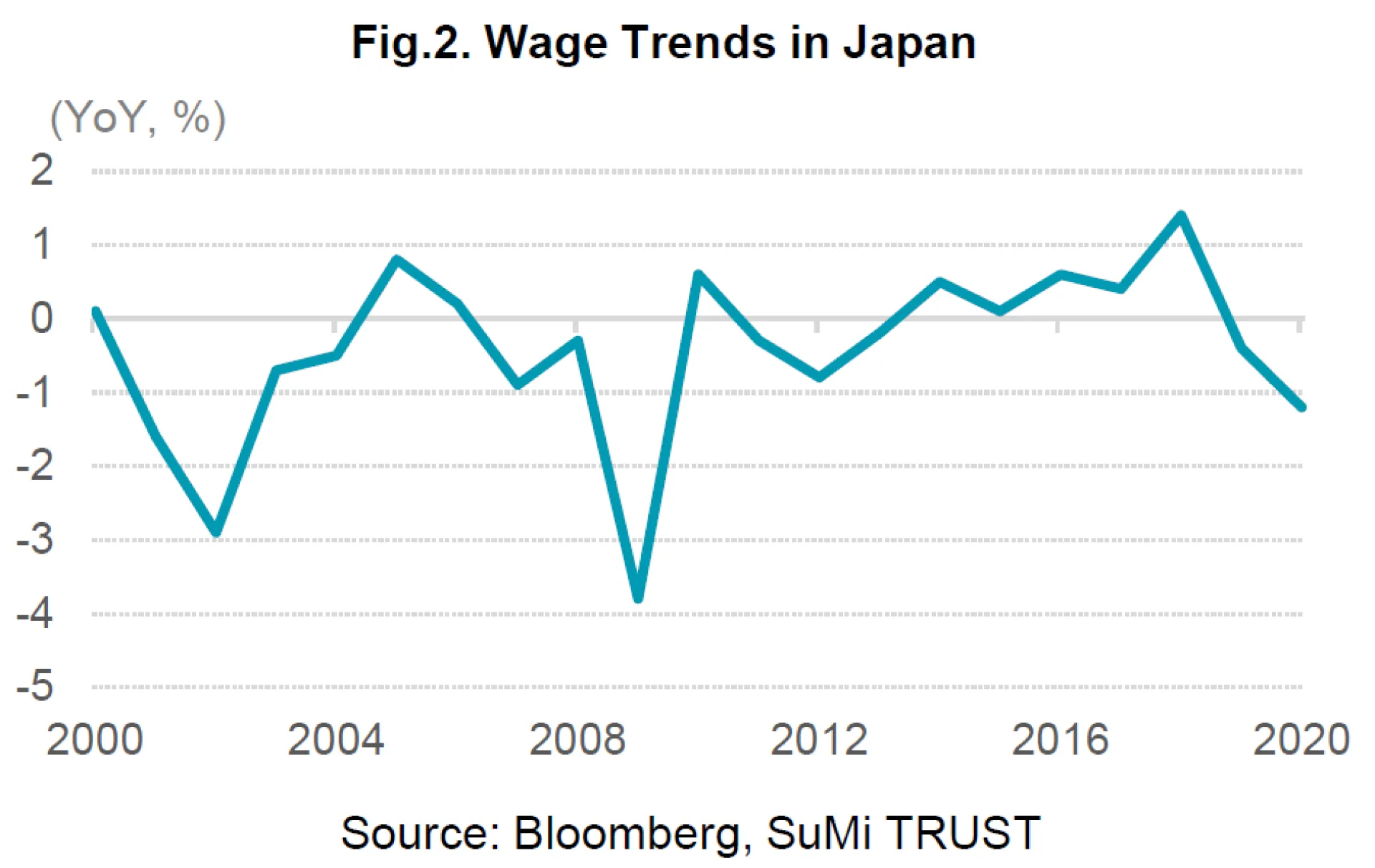

What we can see is that Japanese companies have been reluctant to raise the price of their final products in line with higher costs, and are in fact absorbing the increasing costs. Of course, core CPI may lag corporate prices and is expected to rise. But the phenomenon of companies absorbing global inflationary pressures and deferring consumer prices has long been seen in Japan. Upward pressure on wages in Japan has been weak since the 2000s (Figure 2). If companies raise prices in such an environment, it will reduce the purchasing power of consumers and may dampen personal consumption. On the other hand, companies have sacrificed profits by giving priority to maintaining sales.

Looking at the impact on corporate performance, we see that results have depended on how companies reacted to these events. For example, as result of higher commodity prices, Tokyo Steel (5423 JT) revised its full-year 2021 earnings guidance upwards during the announcement of its earnings for the July-September quarter, while Daido Steel (5471 JT), another steel manufacturer, revised downward its numbers. Tokyo Steel raised its prices in response to higher raw material costs (higher iron scrap prices), and passed it on to its customers, whereas Daido Steel took a more rigid approach by negotiating price increases with customers each time, delaying the pass-through of prices. The difference in corporate strategy has been reflected in contrasting financial results.

2. Direction of Oil Prices

On the outlook of crude oil prices, while we are not optimistic, we believe that the situation should ease toward the middle of 2022. The recent rise in crude oil prices is partly due to higher demand from the resumption of economic activity after COVID-19, as well as the rapid shift to renewable energy worldwide. Power shortages occurred in part due to a fall in the operating rate of wind power generation because of the lack of wind, and demand for fossil fuels rose to fill the gap. Against the backdrop of rising momentum to alternative energy stemming from the global shift to decarbonization, the reluctance to engage in new development projects also contributed to the rise in energy prices. US President Joe Biden has made the fight against higher inflation a top priority, and has shown a willingness to curb energy prices. Although energy demand is likely to remain high this winter due to seasonal factors, the US Energy Information Administration (EIA) expects crude oil supply to catch up with demand in April-June of 2022. While the supply of crude oil today remains tight and unpredictable, the US and OPEC are moving towards increased production and we believe that a further rise in energy prices should be avoided.

3. The Supply Chain Disruption and where we’re headed

We believe that there were two factors which led to supply constraints due to a disruption in the supply chain: the suspension of production facilities due to COVID-19 and the stagnation of logistics.

Due to the spread of COVID-19, production facilities were forced to shut down temporarily in some countries, notably in Southeast Asia, and the supply of not only semiconductors but also electronic parts, resins, iron and others, stagnated, forcing production plans to be delayed. In addition to automobile companies reducing productions, robot manufacturing giant FANUC has announced a downward revision of its earnings forecast despite rising orders as a shortage in parts have worsened since August.

According to the company, which has always been cautious on supply chain management and has held a sufficient inventory of custom-made semiconductors, the company fell short of various general-purpose parts instead of specific parts. The outlook for the future, centered on semiconductors, remains uncertain and the company announced a reduction plan on the assumption that this situation will continue for another six months, but the situation in Southeast Asia is showing signs of improvement.

Although logistics in Japan has been maintained, it is global logistics that has caused great turmoil. In particular, the stagnant North American route due to delays in cargo handling at US ports has adversely affected the entire global logistics network. On October 13th, President Biden ordered the 24 hour, 7-day a week operation of the Port of Los Angeles, and warned that he would fine operators who left containers stranded, and instructed retailers and logistics giants to swiftly clear their inventory back up. As a result, we expect that container ships waiting off the coast of California will be able to berth and offload their cargo, and that the situation will start to improve. The Baltic Dry Index, an indicator of ocean liner freight rates, remains high, but it has been declining since it peaked in early October, and the turmoil is expected to subside.

4. Summary

As mentioned, although the supply of crude oil is expected to exceed the demand in 2022, in the short term, it is highly likely that oil prices will remain high towards the winter. The Japanese economy, which is a net energy importer, currently relies on thermal power generation, which uses fossil fuels, for more than 70% of its energy source. Thus, the impact of higher crude oil prices is significant. For many companies, higher crude oil prices not only lead to higher fuel costs, but also to higher logistics and packaging material costs, which has a negative effect on business performance. Currently, some companies are passing on their cost increases to their product prices, as seen with Nippon Steel negotiating its price increases with automobile manufacturers. Thus, corporate strategies will affect future business performance.

In addition, on supply constraints due to turmoil in the supply chain, we believe the situation will be resolved. According to the July-September corporate earnings, which is currently being announced, orders have generally been firm, and if the turmoil can be resolved, we believe that a recession caused by supply side bottlenecks can be avoided.

The outlook for the Japanese stock market is backed by expectations for future economic measures, improving consumer sentiment due to falling COVID-19 cases, and a steady recovery from the COVID-19 pandemic as confirmed in the July-September corporate earnings results. The Nikkei 225 average is expected to solidify above the 30,000 mark towards year end.

Regarding trends in the market, we expect higher US interest rates, yen depreciation and rise in commodity prices to continue, and hence value stocks may dominate in the short term. As a rule of thumb from the past, value stocks such as commodity and energy-related stocks as well as financials performed well when commodity prices were high and interest rates were rising. As the Fed conducts tapering and as monetary policy normalizes, we expect US interest rates to remain on a gradual uptrend, which should be a positive for financials as they improve their margins. In addition, higher commodity prices will be a tailwind for commodity and energy stocks, and yen depreciation against the backdrop of rising US interest rates should have a positive impact on the automobile sector.