Coffee Break Column

In 2023, Japan recorded a 3.60% increase in its average wage, the first rise in nominal wages in 30 years since 1993, thanks to multiple factors, including a severe labour shortage. However, real wages have remained negative year-on-year for 22 consecutive months from April 2022 to December 2023 because of rising prices.

In 2024, Shunto, a spring wage negotiation between labour unions and companies, is in the spotlight over whether real wages will turn positive. The Bank of Japan (BOJ) is also focusing on real wage growth as a pre-condition for normalising monetary policy. In other words, wage trends in 2024 will be an important factor for the future of Japan’s monetary policy. Most market participants expect that the BOJ will start to normalise monetary policy in March or April, meaning that the market consensus is that real wages will turn positive in the coming spring.

In this report, we would like to explain our view on wage increases in 2024, focusing on small and medium-sized enterprises (SMEs), which are also being closely monitored by the Governor of the BOJ.

Outlook for wage increases in 2024

Let us introduce our outlook for wage increases this year. We forecast that wages in 2024 will increase at the same level as we saw in 2023, if not more. Meanwhile, we predict that the Consumer Price Index (CPI) will increase by 2.2% in 2024, which indicates that inflation will slow down compared to last year. Under these circumstances, real wages will finally turn positive if we see a wage increase at the same level as last year. A survey by the Institute for Labour Administration shows that the forecast for wage increases by the labour side has become more bullish than last year. These bullish predictions are possibly due to high inflation and an active job market in 2022-23. At the same time, it does not seem to be the case that management is reluctant to raise wages. In the survey for management, nearly 50% of management teams answered that they will increase wages in 2024. This figure jumped to 75% when including respondents who answered that they were considering raising wages.

TOYOTA’s labour union is a key player in the trend towards wage increases among large enterprises. According to reports in the Yomiuri newspaper on 29th January, a wage increase demand from the TOYOTA labour union for the Shunto was two to three times higher than last year's level. The company has accepted the full demanded wage increase for the last three consecutive years and was one of the first major manufacturing companies to make a response in Shunto. For this year, TOYOTA announced that it will once again accept the full demanded wage increase, and many companies, including those in the automotive sector, are now following TOYOTA's lead and have announced that they will match the demanded wage increases or have offered even higher wage increases.

Are wage increases for SMEs feasible?

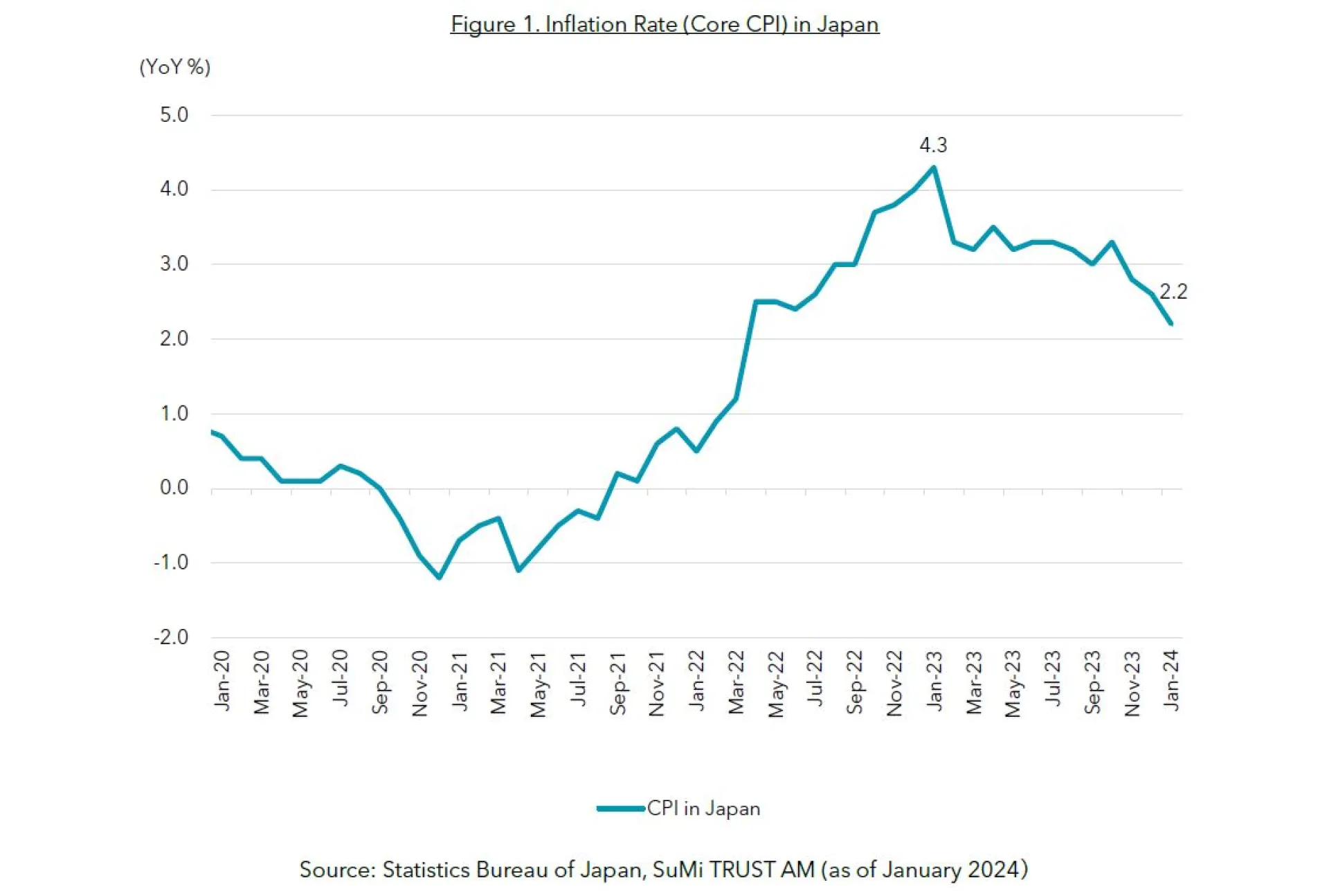

However, wage increases at large companies alone will not generate enough impact on the Japanese economy and the BOJ to change its policies. It is worth noting that the trend of wage increases among SMEs is also being closely observed by the BOJ's Governor, Kazuo Ueda. At a press conference in January 2024, Governor Ueda stated that the key point for determining monetary policy is "how much impact SMEs, which have a large weighting, have on the average wage movement in the economy as a whole". On 14th February, the Japanese Chamber of Commerce & Industry (JCCI) published survey results which provide a useful insight into wage trends among SMEs this year. The survey, which was conducted among 6,013 SMEs, illustrates the situation surrounding labour shortages and the intentions of SMEs to raise wages. 65.6% of companies in all industries stated they are short of manpower. In response to this situation, 61.3% of companies said they plan to increase wages, which is 3.1% higher than the previous year. As for the degree of the wage increase, 36.6% of companies said that the wage increase would be "more than 3%". This is also a 3.1% increase compared to the previous year. According to a survey by the Japanese Trade Union Confederation (JTUC-RENGO), a labour union organisation, the wage increase rate for SMEs was high at 3.23% as a result of last year's Shunto, yet given the severe shortage of human resources, the wage increase rate for SMEs is expected to be at the same level or even higher than last year. Considering the current CPI level, which increased by 2.2% in January 2024 on a year-on-year (YoY) basis, real wages in 2024 will be positive if we see the same rate of wage increases as last year, which was around 3% (Figure 1).

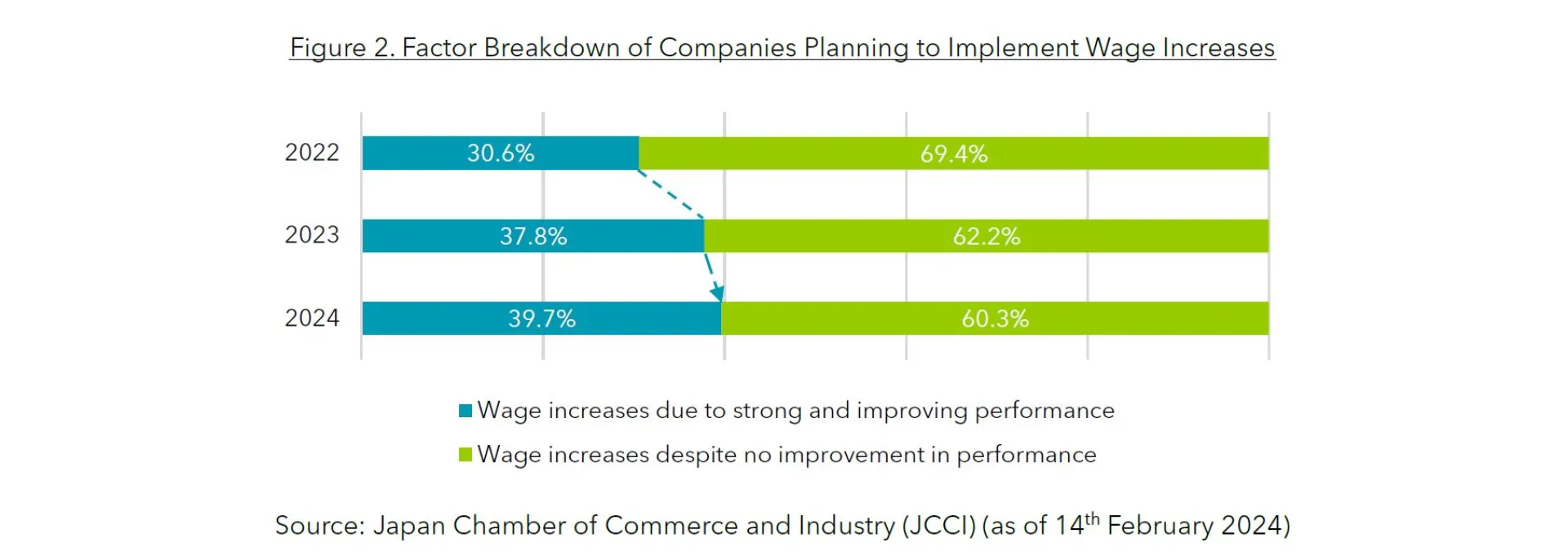

In fact, the percentage of companies offering positive pay rises due to strong performance is on the rise, rather than defensive pay rises where there is no improvement in performance, but the company is forced to raise wages (Figure 2). As real wages continue to turn positive in the future, more positive wage increases will be implemented, which will take place on the back of strong business performance.

The outlook for SMEs

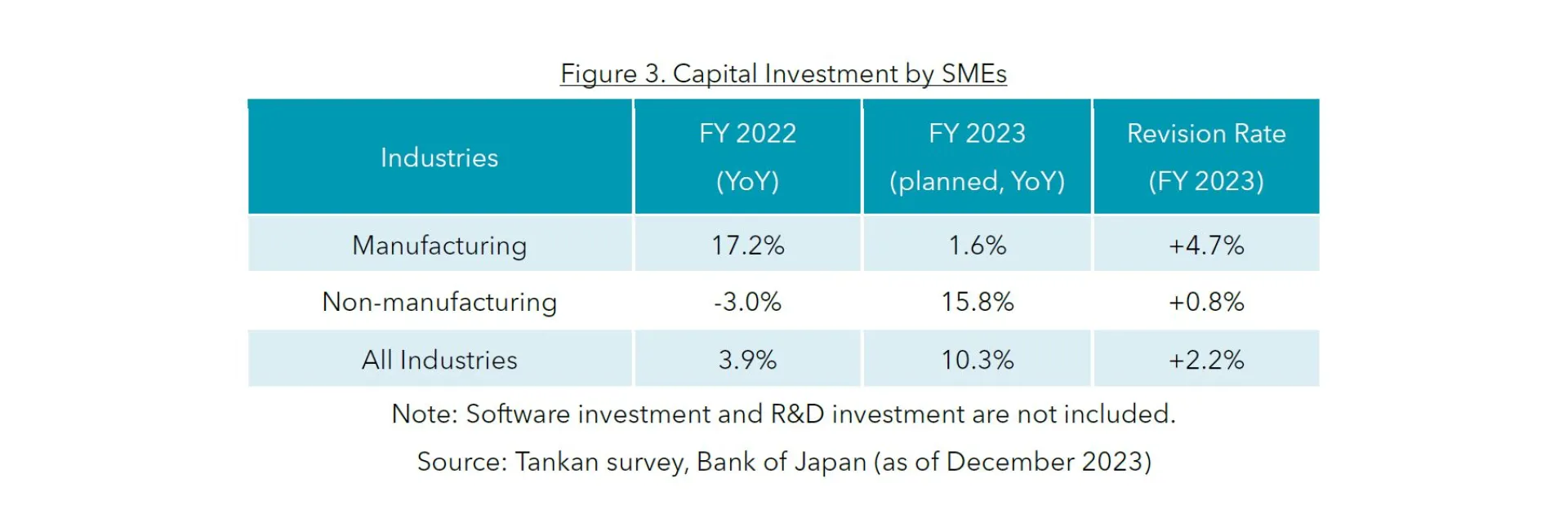

Despite the wage increases, SMEs are still facing severe labour shortages. According to the survey by JCCI, only 26.6% of companies were working on 'utilising IT, machinery and robots' to address the labour shortage at this moment, but we believe this number will increase going forward. Indeed, to solve the challenge of labour shortages, SMEs are increasing their capital investment. The BOJ's Tankan survey shows that corporate appetite for investment in equipment appears to be increasing, including among SMEs (Figure 3). There is a strong possibility that Japan’s labour productivity, which is lower among developed countries, will catch up along with an increase in the capital-equipment ratio. The increase in capital investment and improved productivity of companies will boost the overall Japanese economy.

Sustainable wage increases are close to being a reality

The 'Main Opinion' on the Monetary Policy Meeting for January 2024 was published and the positive comments on the lifting of negative interest rates based on the conditions of wage increases were highlighted. The market consensus is already that wage growth will continue this year, but the important point is how high the rise will go, especially with regard to the normalisation of monetary policy. If wages increase by the same level or more as last year, real wages will finally turn positive. This would have a significant impact on the BOJ's monetary policy changes and Japanese consumer spending would also continue to be robust.