It has been more than seventy years since the publication of anthropologist Ruth Benedict’s study of Japan’s society and culture “The Chrysanthemum and the Sword”, but her observation that the Japanese people are hypersensitive to the expectations of (and potential for criticism from) those around them is still true today. In fact, this group mentality may even be stronger in 2024 than when Benedict’s text was published in 1945, given that the Japanese phrase “reading the air” is now used in English to describe navigating non-verbal cues and societal expectations. It has been hypothesised that this group mentality explains the long hours of overtime put in by Japanese employees. In which case, data released by the Japanese cabinet office in February showing that German GDP overtook Japan in 2023 on just two thirds of the working hours is a bitter pill to swallow.

Is a group mentality always bad, though? Not if used in the right way. For example, it has been put forward that Japan was able to achieve a comparatively low morbidity and mortality rate during the COVID-19 pandemic thanks to the group mentality of the Japanese public; even without legal restrictions on personal freedoms, the general population voluntarily wore face masks and avoided gathering in public spaces to curb the spread of the virus.

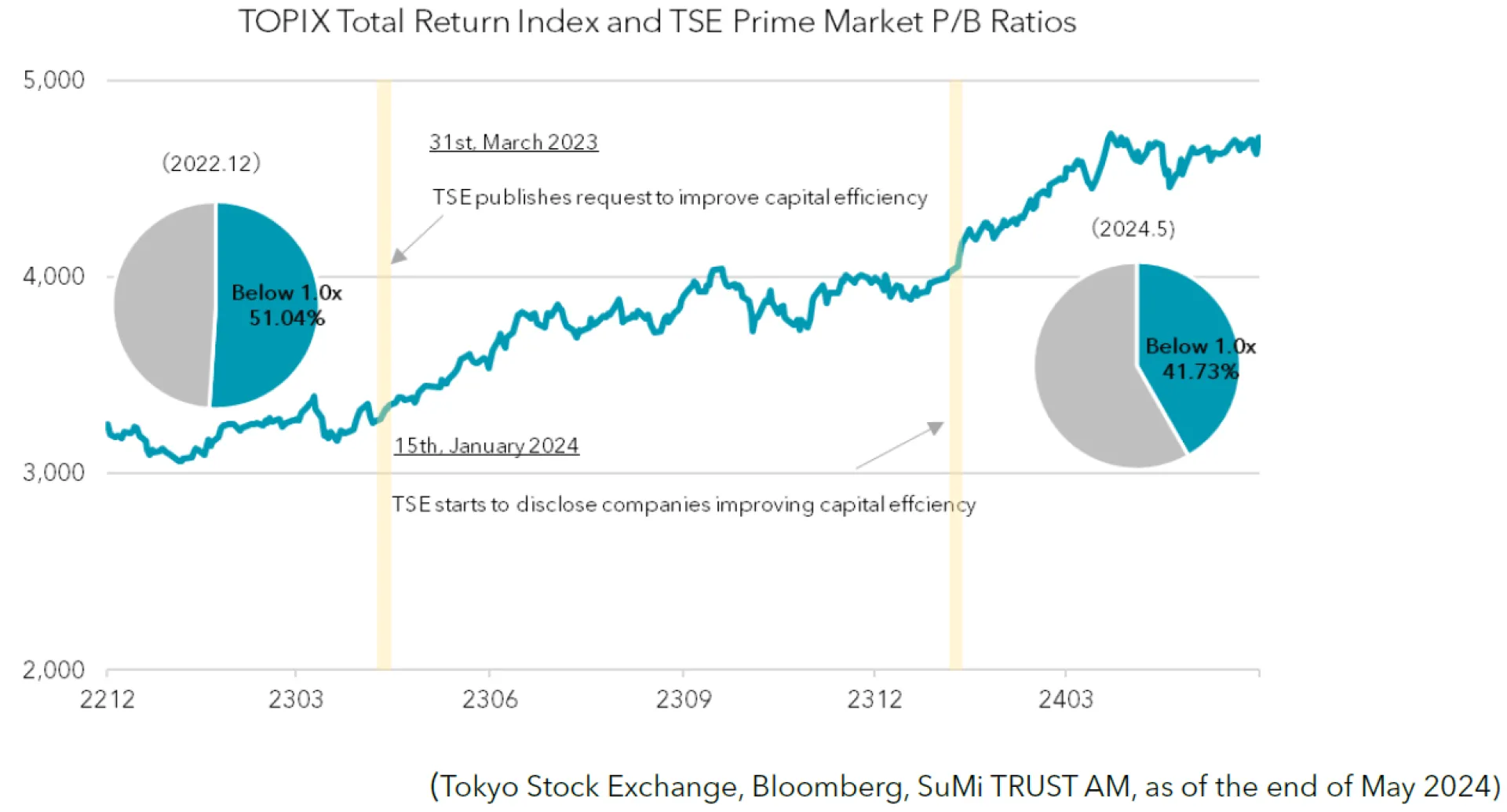

In recent years, we have observed intriguing developments in the approach of Japanese corporations to shareholder returns that are also the positive result of a group mentality. In March 2023, the Tokyo Stock Exchange (TSE) published a request to all listed companies asking them to take “action to implement management that is conscious of cost of capital and stock price”. In October of the same year, the TSE followed up its request with an announcement that it would publish a list of companies that acted in response to the request. This list would be published monthly on the TSE’s homepage from January 2024 - and in fact the Tokyo Stock Exchange even went as far as publishing a full copy of the list in the morning edition of the Nikkei newspaper on May 10th, 2024.

Despite this being no more than a request and not an order, Japanese companies responded with a notable move to deliver greater corporate value for shareholders including increased dividends and improved shareholder return policies. The potential embarrassment of not making the TSE’s list (the ‘shame factor’) resulted in a rush of companies taking action to avoid criticism from shareholders and the general public.

As a result, the weighted average Price-to-Book ratio for companies listed on the Tokyo prime market was 1.2x in December 2022, but in just one year this jumped to 1.6x in March 2024 (please see the chart above). Over a similar timeframe, the percentage of prime market listed companies with a PBR of less than 1x fell from 51% in December 2022 to 42% in May 2024. In addition, the ratio of companies who have publicly announced action to implement “management that is conscious of cost of capital and stock price” jumped from 49% in December 2023 to 65% in March 2024. While this change may have happened naturally over time, the TSE broadcasting its intentions to publish a list ahead of time and triggering the group mentality of Japanese companies was a key factor that accelerated the process.

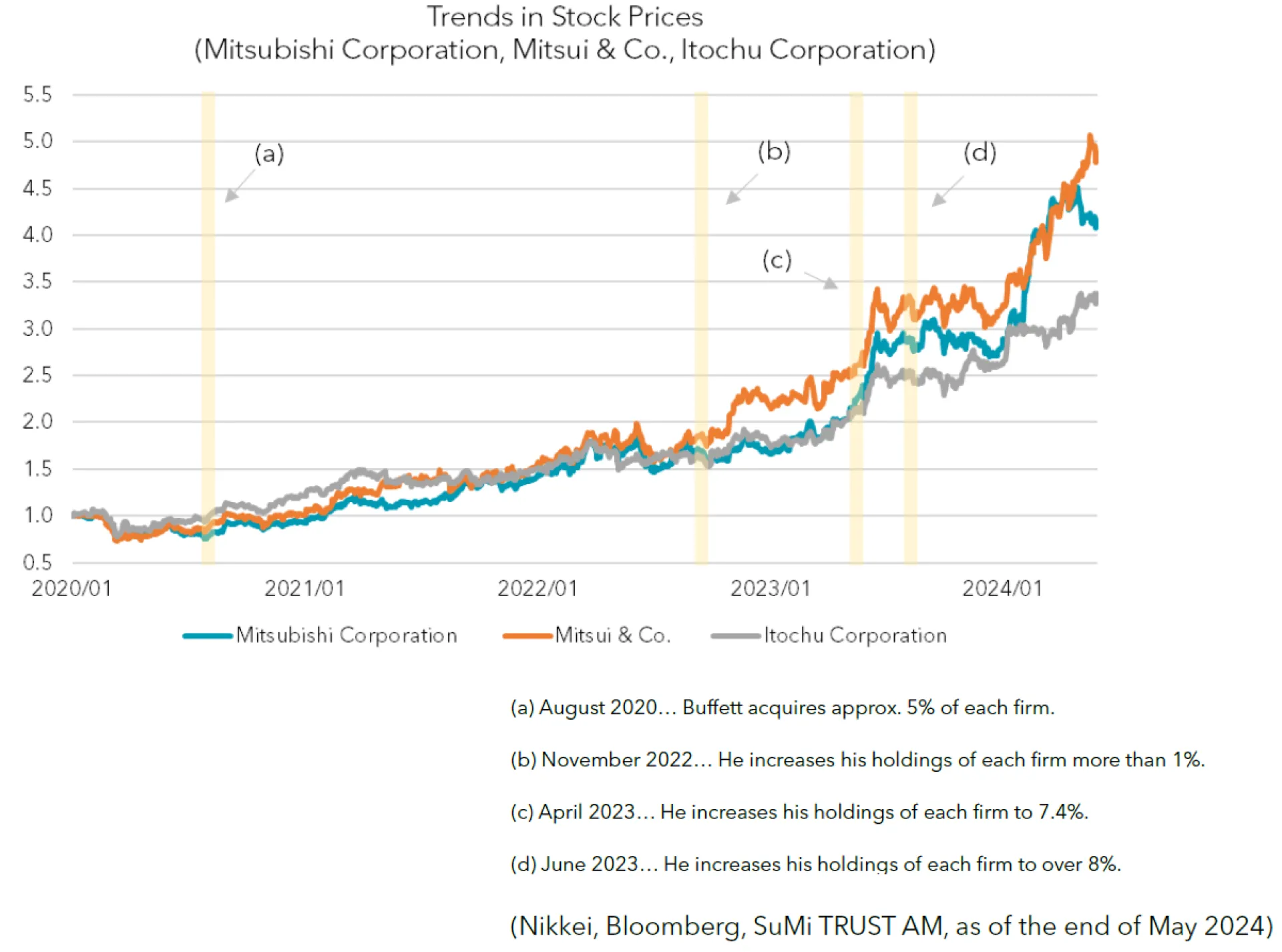

Elsewhere, could we explain Berkshire Hathaway’s stake in all five major Japanese trading companies (namely Mitsubishi Corporation, Mitsui & Co., Itochu Corporation, Sumitomo Corporation and Marubeni Corporation) as a shrewd decision based on investment god Warren Buffet’s personal insight into the Japanese group mentality? Whether or not that is the case, looking at how the management of these five companies are improving their shareholder payout policies, it seems that the Japanese group mentality is certainly at work.

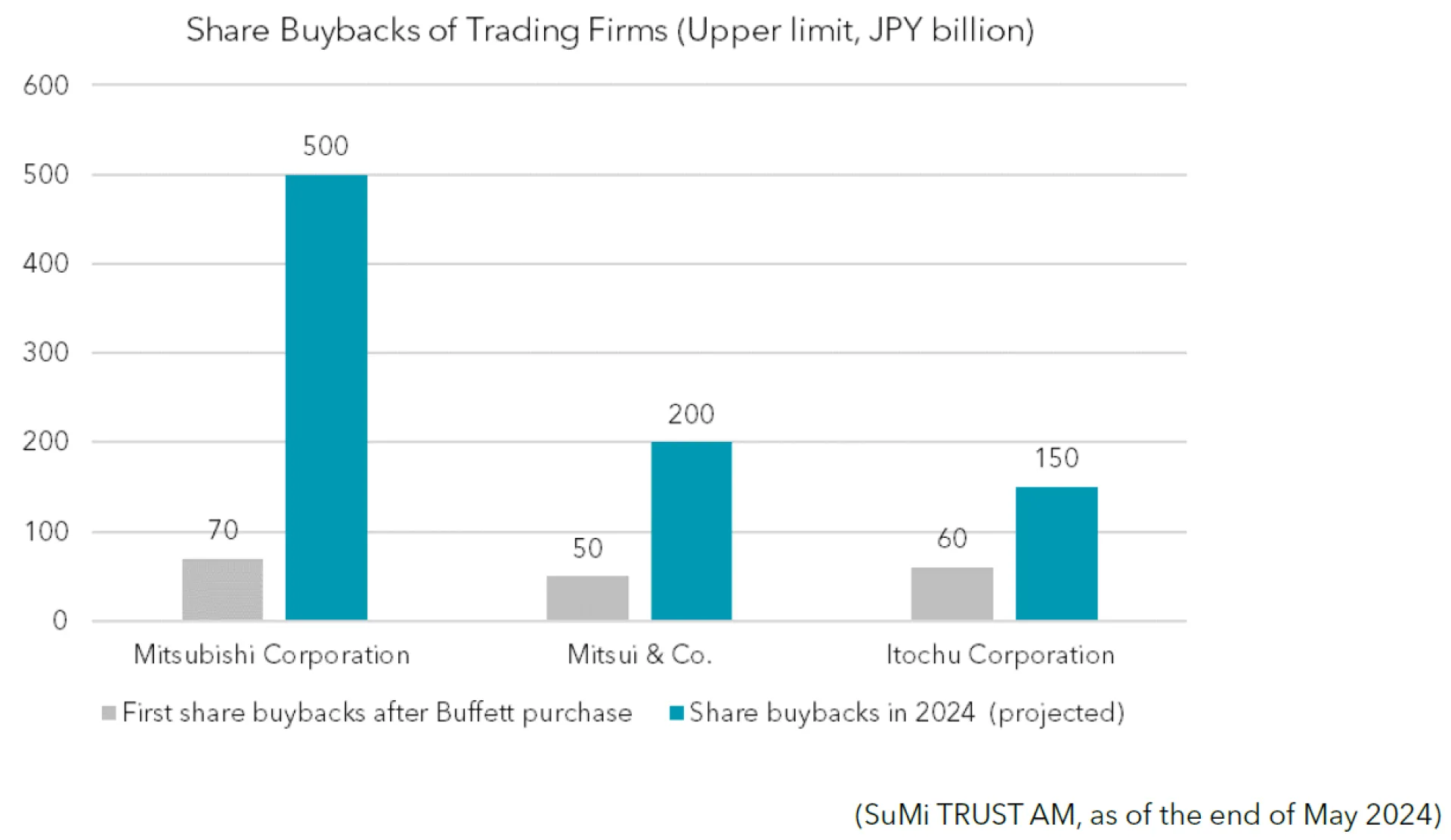

For example, in February this year Mitsubishi Corporation surprised the market by announcing a share buyback program with an upper limit of 500 billion yen (amounting to 10% of its issued shares) in addition to a share buyback program already announced for 100 billion yen. In the same month, Sumitomo Corporation announced a 50 billion yen share buyback program. This was followed by Itochu announcing a 150 billion yen buyback in April, and both Mitsui & Co. and Marubeni Corporation announcing share buybacks in May of 200 million and 500 million, respectively.

All five have announced an increase in dividends. Mitsui & Co., Mitsubishi Corporation and Itochu Corp have announced dividend increases in competition with each other. Seeing this, Sumitomo Corporation and Marubeni Corporation followed afterward. This is not a one-off event. In their most recent financial statements, all of the companies except Itochu confirmed that despite a downturn in profits they would continue to proactively pursue greater shareholder returns. Of course, the abundant reserves of cash held by these companies is a big factor in their decision to boost shareholder returns, but it is not the only reason that they choose to do so. The companies are highly conscious of both their rivals and the expectations of Berkshire Hathaway; all five want to avoid the embarrassment of being the only member of their group to be sold off by Buffet on a falling share price caused by a lack of shareholder returns.

These are a just a few examples of the Japanese group mentality at work in the realm of shareholder returns. PBR improvements would usually come from an increase in ROE and profits, but whether this is realised in Japan remains to be seen. Whatever the catalyst, the key going forward is whether Japanese companies continue to raise corporate value and meet shareholder expectations or not.