The impact of exchange rates on corporate performance

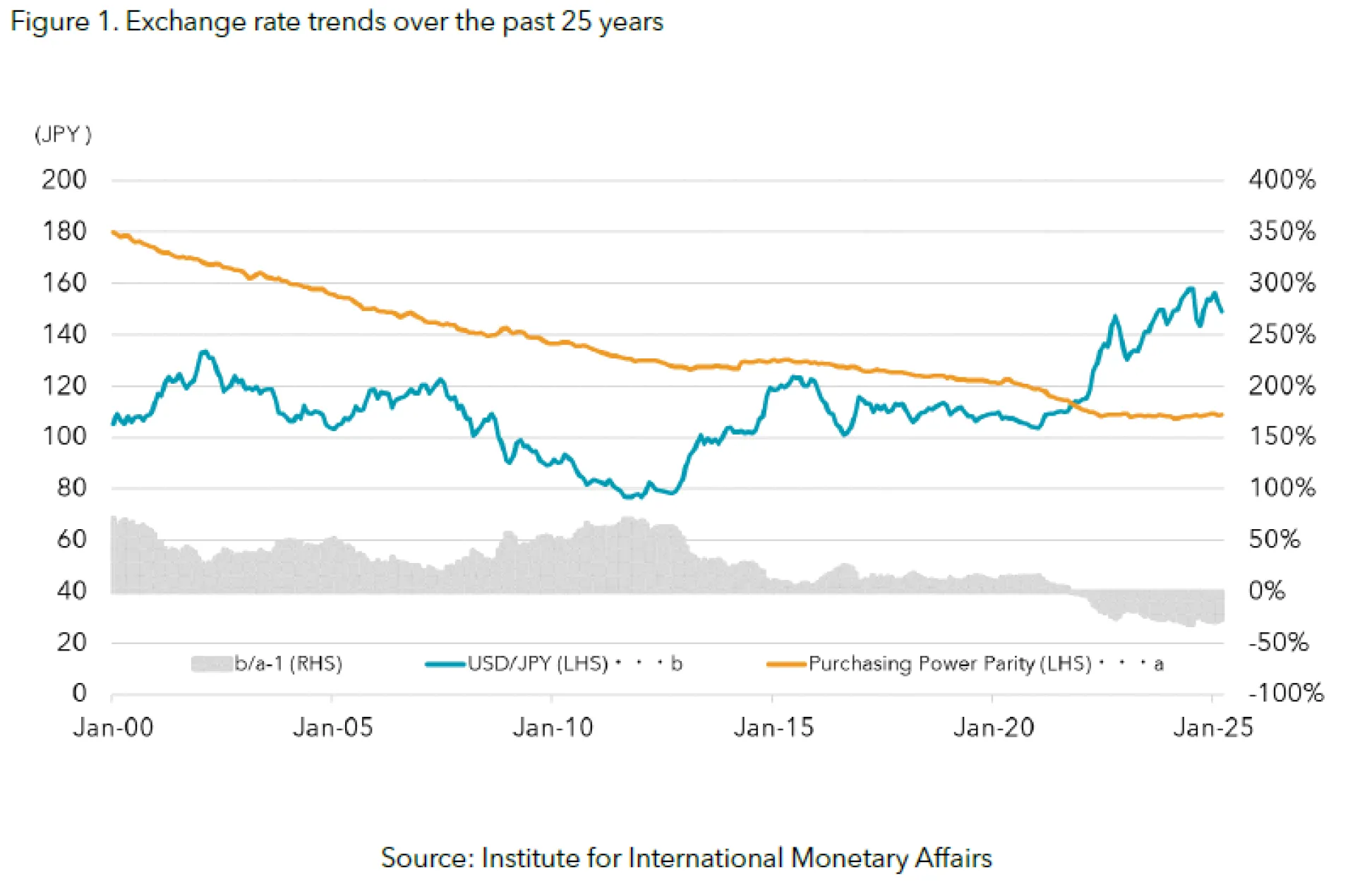

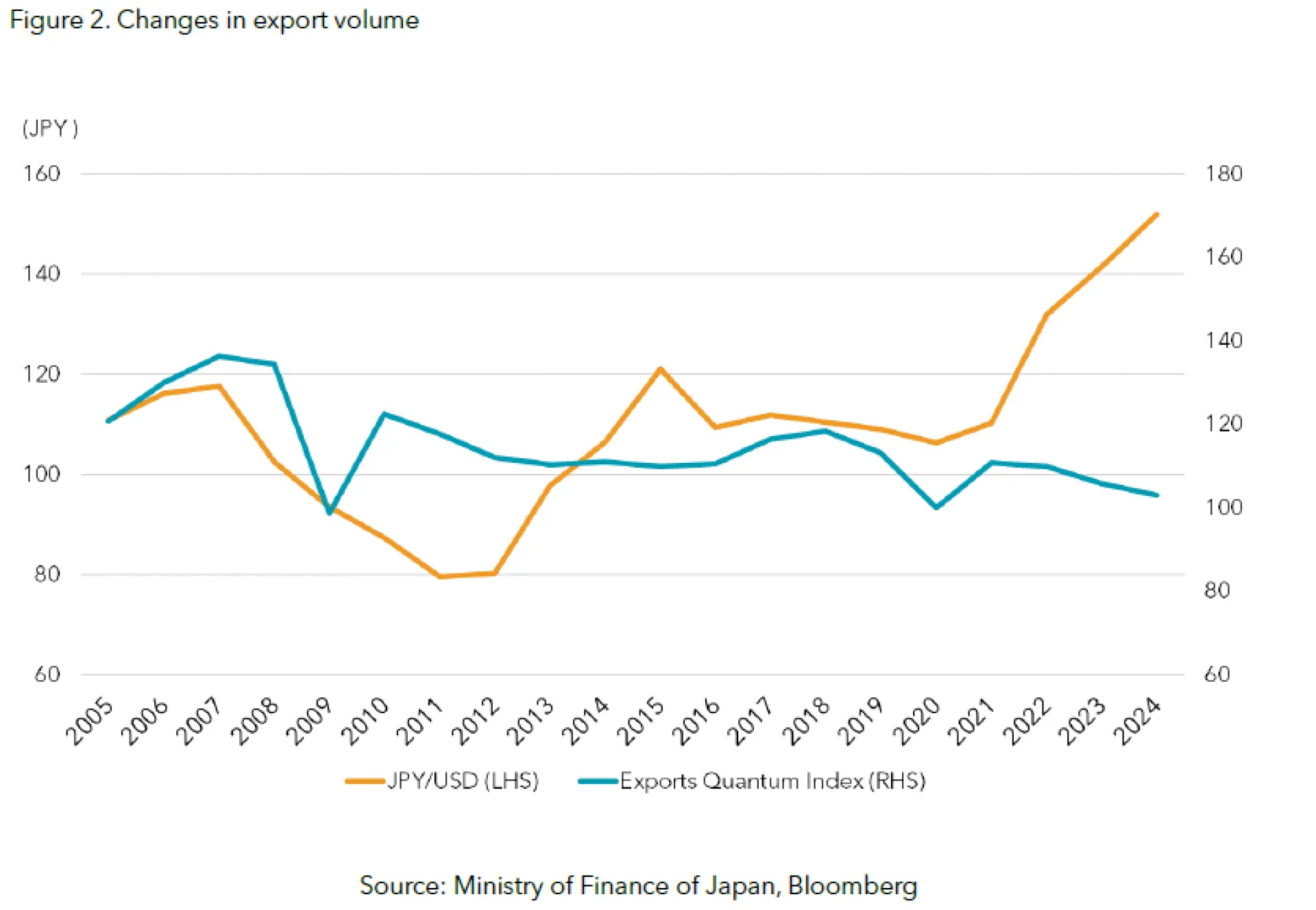

While a correction in yen depreciation offers some benefits to Japanese consumers through stable import prices, it undeniably has a negative impact on the performance of publicly listed companies. A large proportion of Japanese listed companies are internationally competitive, export-oriented multinational corporations, such as those in the automotive sector. This means that the positive effects of yen depreciation have historically had a more pronounced impact on corporate earnings than on the Japanese economy as a whole. However, the positive effects of yen depreciation on exporters have shifted in recent years. As shown in Figure 2, export volumes from Japan have not increased despite the continued weakening of the yen in recent years. This is due to electronics manufacturers shifting production bases to low-wage countries such as China and those in Southeast Asia, and automotive manufacturers increasing local production in consumption-heavy regions like the U.S. Lessons learned from past events such as the Global Financial Crisis (GFC) have led exporters to build business structures more resistant to exchange rate fluctuations. Thus, the current benefits of yen depreciation for exporters are limited to increases in yen-denominated exports and the conversion of overseas subsidiaries' profits into yen.

In the past when Japan served as the world's factory, yen depreciation triggered increases in export volumes, which led to higher capital investments to expand production capacity, boosting the overall economy, including personal consumption, through higher employment and income. Conversely, rapid yen appreciation negatively impacted domestic demand, as seen in 1995 after the bubble burst and in 2008 during the GFC, causing a severe economic impact. However, today, exchange rates have a limited knock-on effect on the domestic economy.

The impact of exchange rates on stock prices

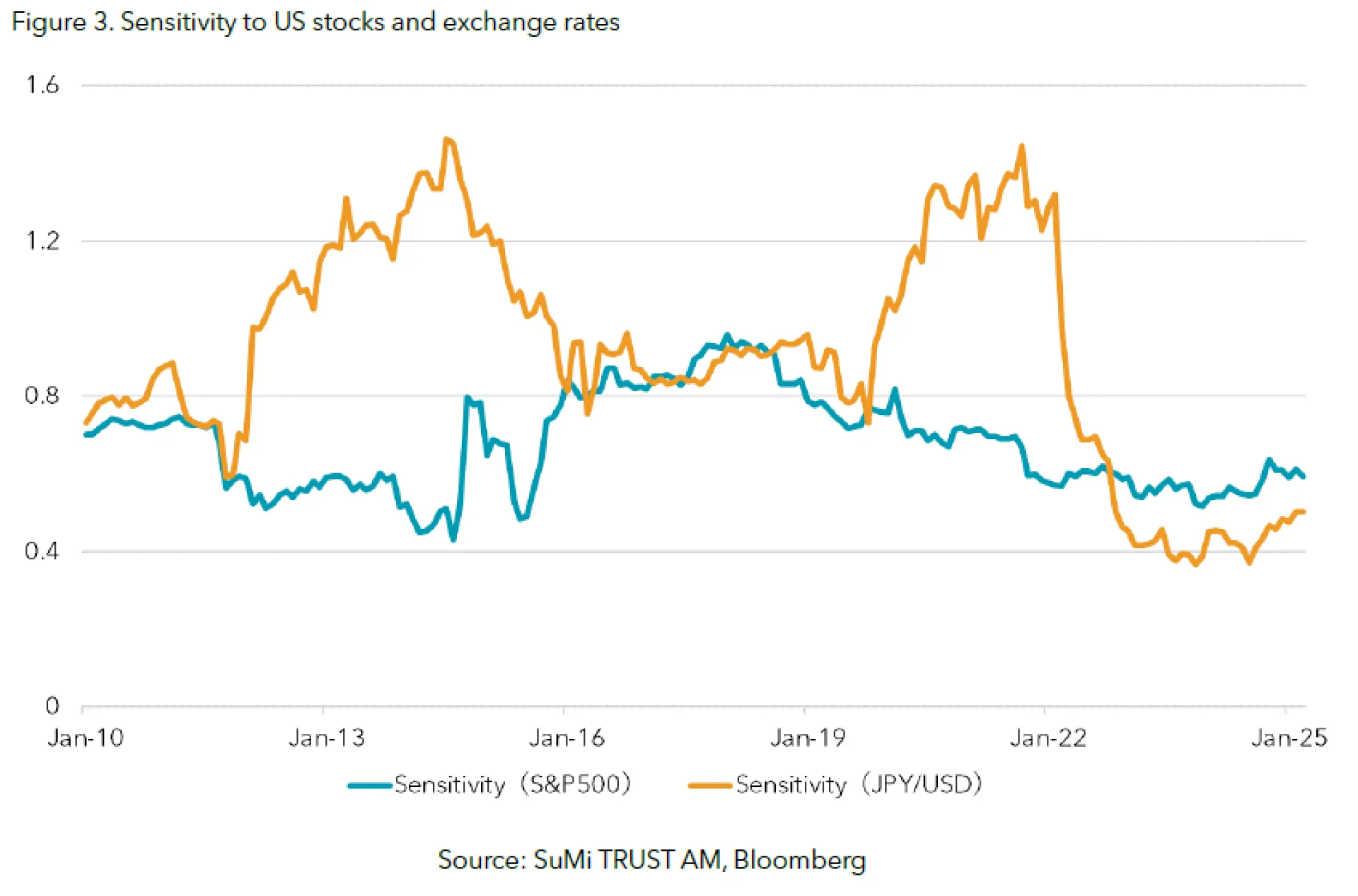

It is said that Japanese stock performance can be explained by the movements in U.S. stocks and foreign exchange rates. Figure 3 illustrates the sensitivity of Japanese stocks to U.S. share prices and exchange rates over time, showing the percentage change in Japanese share prices for each 1% movement in the S&P 500 or USD/JPY. The sensitivity to exchange rates has trended downward over time, reflecting changes in Japan’s economic structure, where export volumes no longer increase with yen depreciation, and the decreasing impact of exchange rates on corporate earnings.

In the short term, as seen in August 2024, Japanese stocks may experience significant declines alongside rapid yen appreciation. However, in the long term, the impact of exchange rates on Japanese stocks should become more limited. Going forward, even should the yen appreciate moderately due to diverging Japan-U.S. monetary policies, fundamentals such as corporate earnings and economic conditions should outweigh its effects unless market panic sets in or a risk-aversion-driven rapid yen appreciation occurs.

Japan's autonomous recovery process

The historic rise in Japanese stocks since the pandemic is not solely attributed to yen depreciation. It reflects fundamental structural changes in the Japanese economy and corporate governance reform, leading to a new all-time high after 34 years.

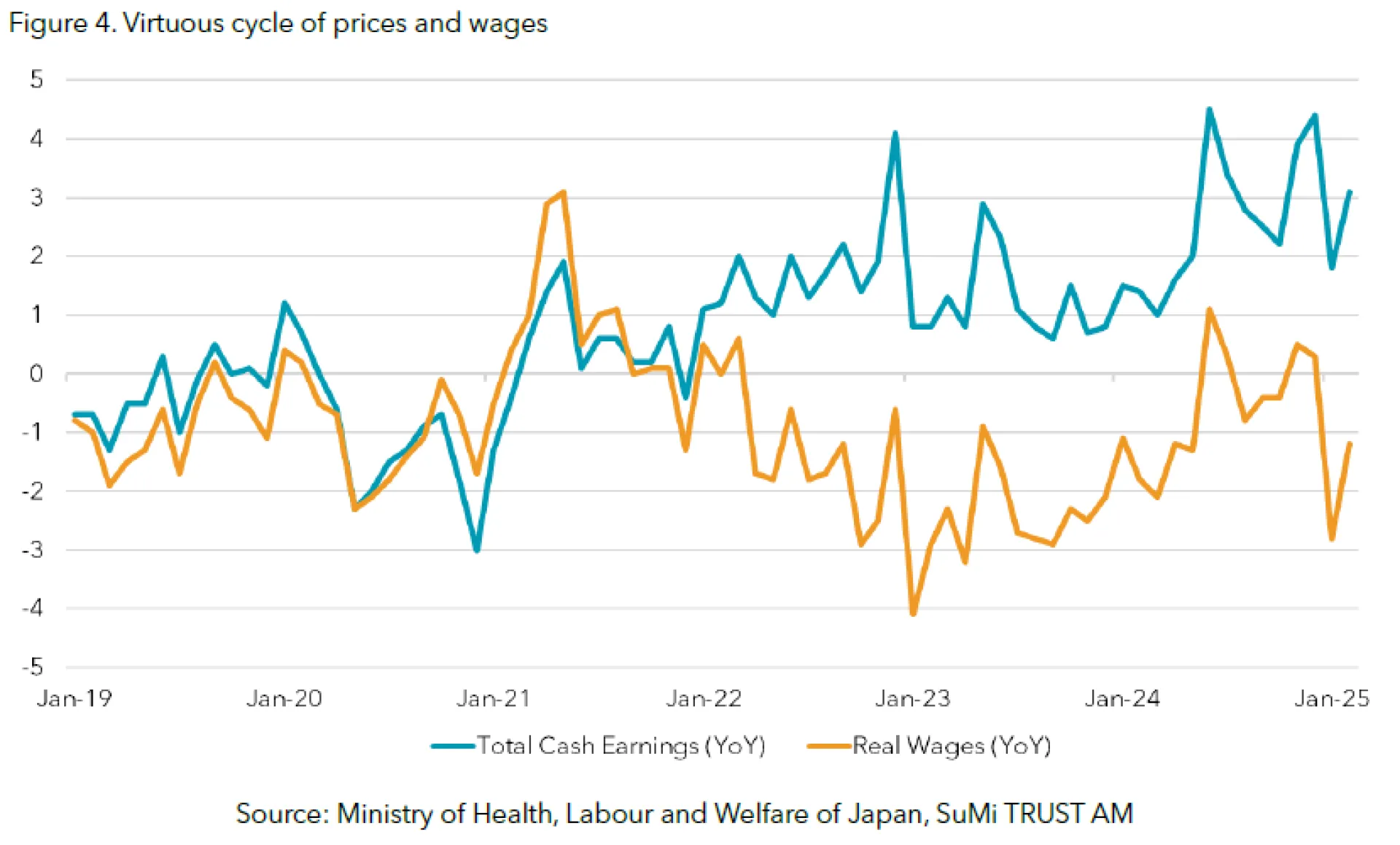

Currently, Japan is at a turning point, transitioning from decades of deflation to moderate inflation. Inflation expectations by the consumer have risen sufficiently, allowing businesses to set appropriate prices. While price increases initially outpaced wage growth, wages are catching up. Higher positive real wage growth is expected to stimulate personal consumption. Labour shortages are also prompting companies to revise production lines for further efficiency and to invest in digital transformation. These trends represent a self-sustaining movement with continued progress.

Corporate governance has garnered significant attention, particularly the initiative to raise the Price-to-Book Ratio (PBR) by the Tokyo Stock Exchange. In reality, Japan's corporate governance reform is a multifaceted effort to enhance corporate value, promoted by various bodies such as the Financial Services Agency, the Ministry of Economy, Trade and Industry, and the securities industry. Recently, we have seen progress in the unwinding of cross-shareholdings, and there has been an increase in shareholder proposals at general shareholder meetings, reflecting positive results.

Outlook for Japanese stocks

The financial market turbulence in early April has subsided for now. While the outcome of tariff negotiations remains uncertain, the impact of the Trump administration’s policies, including tariffs, on the global economy and corporate earnings will become clearer in the latter half of the year. Once visibility improves and the investment environment stabilises, market participants are expected to focus on fundamentals again. Even in the event that the yen continues to appreciate gradually, we believe the Japanese stocks will remain attractive, driven by structural changes in the Japanese economy and recovery in corporate profitability.