1. Japanese Economic Forecast

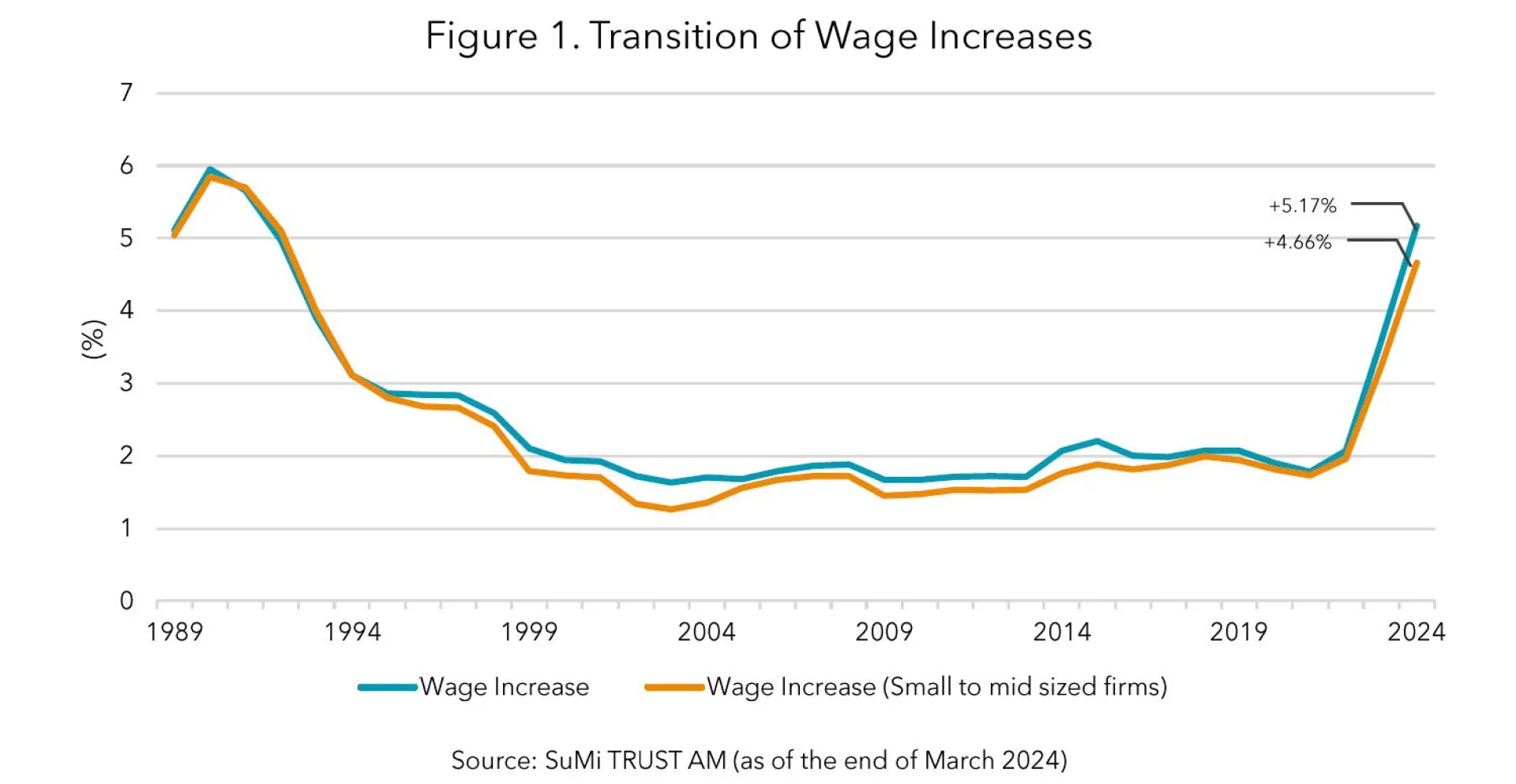

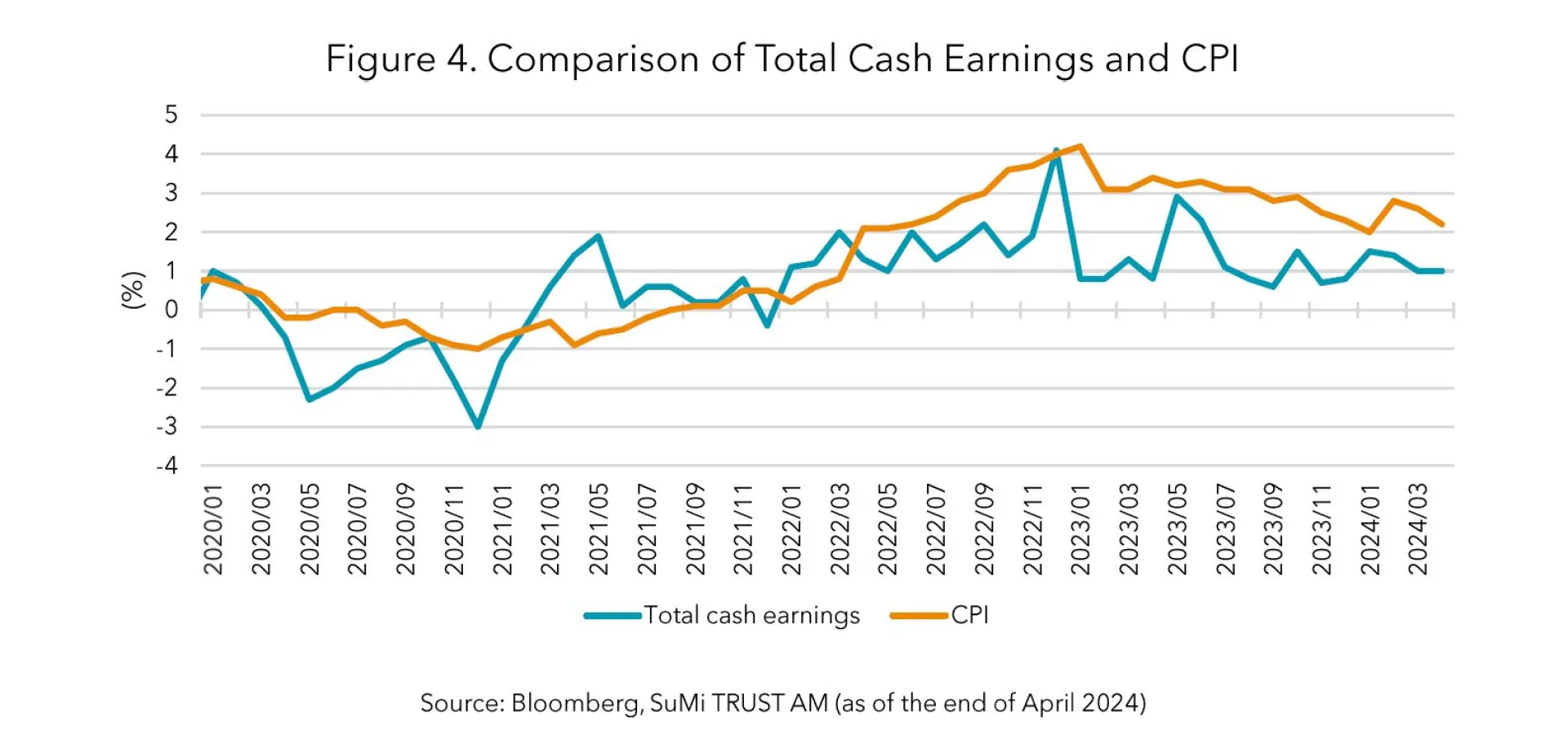

Avoiding a return to deflation will be the key focus in the second half of 2024. It is crucial for the Japanese economy to transform itself from a cost-cutting economy for the past 30 years, to a growth-oriented economy, driven by sustained wage increases and active investments. Real wages are likely to turn positive in the summer as corporate earnings remain solid and wage increases have been achieved in the spring labour offensive.

The outlook for private consumption is expected to pick up gradually in the latter half of 2024 as real wages are expected to turn positive in the summer. The wage increase announced in the 2024 spring labour offensive by the Japanese Trade Union Confederation was 5.17%, which is considered very high. We expect private consumption to rise as wages increased in May and the employment rate continues to improve. Personal consumption will remain firm, underpinned by increasing disposable income on the back of tax cuts* which will be implemented in June.

Corporate earnings have reached new highs from the effects of price increases, depreciation of the yen, and the recovery in inbound tourism. In the BOJ’s Short-Term Economic Survey, capital expenditures for FY 2023 were +13.1% year-on-year. Taking these into account, we see a continued trend of capex into 2024 that should solve the problem of labour shortages. Moreover, higher exports and production may boost capex in the manufacturing sector.

*A 30,000-yen income tax cut and a 10,000-yen residential tax cut will be applied per individual.

2. Outlook on Monetary Policy

Attention is likely to be drawn on whether the BOJ will hike rates further. Currently, there is growing speculation that the BOJ may announce an additional rate hike by the summer. A change in the BOJ’s attitude towards monetary policy was observed as Governor Ueda stated, “We will pay close attention to the yen depreciation” after a meeting with Prime Minister Kishida on 7th May. Additionally on 13th May, the BOJ reduced its purchase of government bonds (JGBs) with maturities between 5 and 10 years compared to its previous purchase. We expect the 10-year JGB yield to remain in the 0.60% to 1.20% range until the end of 2024. Furthermore, there is a growing anticipation for a number of rate cuts in the US within the year. With the recent CPI and other indicators suggesting a slowdown in inflation, there is increasing speculation that the Fed might cut rates at least twice within the year. However, the number of rate cuts could change depending on economic indicators and the results of rate cuts. The 10-year US Treasury note should trade in the range of 3.75% to 4.75% until the end of 2024.

3. Outlook on the Japanese Stock Market

The Japanese stock market is expected to remain firm on the back of an expected soft landing of the US economy, solid corporate earnings, and higher shareholder returns. In addition, calls for a higher Price-to-Book Ratio (PBR) and capital efficiency by the Tokyo Stock Exchange (TSE) as well as the expansion of the Nippon Individual Savings Account (NISA) - an investment tax exemption scheme - will likely support the market. In March 2023, the TSE requested companies with a low PBR to disclose and implement improvement measures. For many years, poor capital efficiency and low profitability of Japanese companies, in addition to the undervaluation of their shares have been pointed out. In response to this, the TSE has started to take concrete action. The TSE aims to enhance the value of listed companies and increase the attractiveness of the market. Among companies with a market capitalisation of over 100 billion yen, 45% of companies with a PBR of less than one indicated their willingness to take action, and there have been cases where their share prices have risen. Since the beginning of the year, more concrete measures have been announced and they will continue to be a supportive factor.

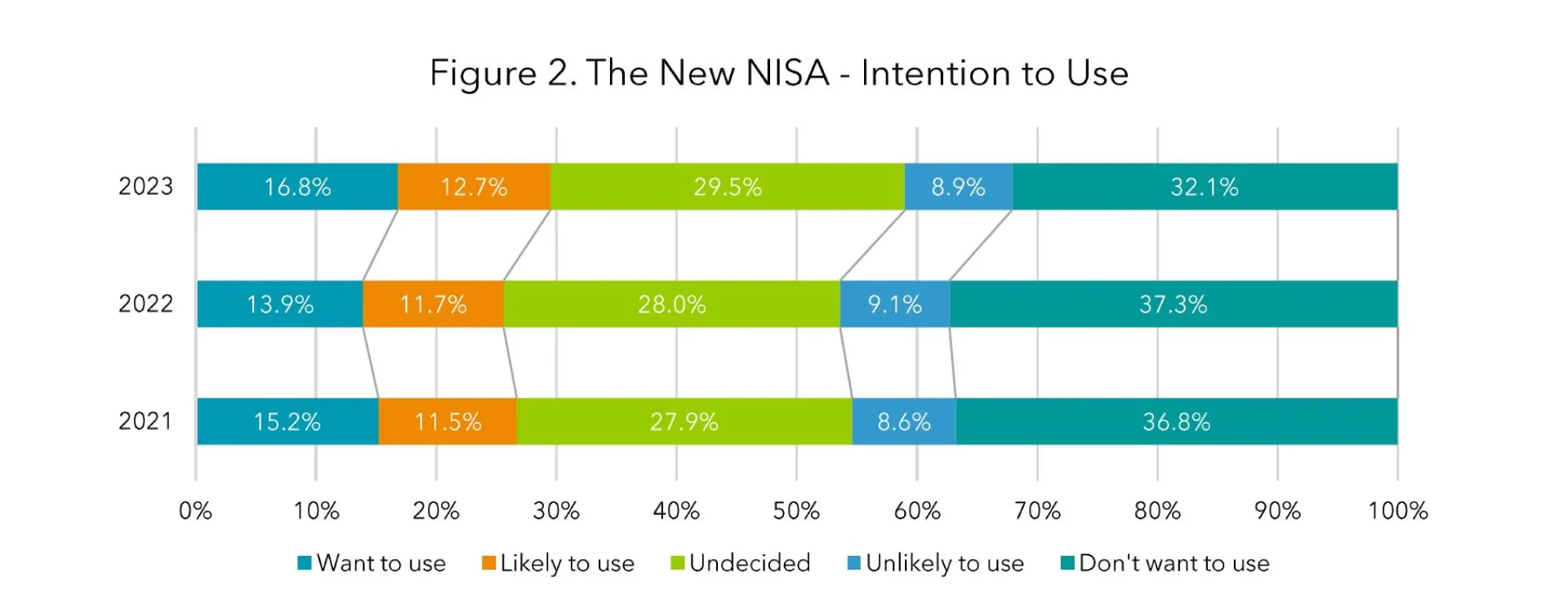

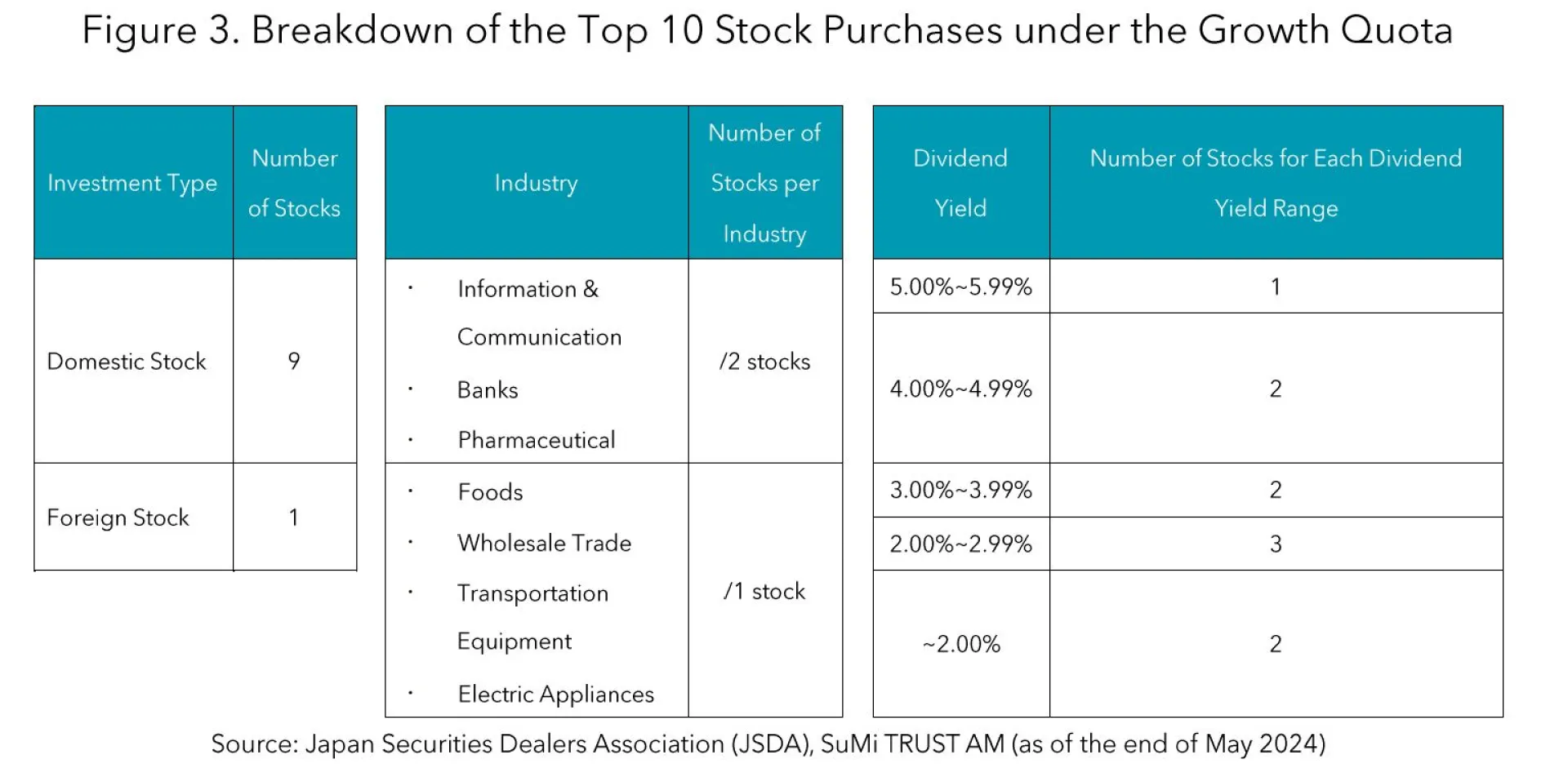

The new NISA tax exemption scheme was launched in January 2024. According to the Japan Securities Dealers Association (JSDA), Japanese equities were mostly purchased in the growth quota*, and this is thought to be a factor supporting the market. The JSDA published materials on 21st March concerning the opening of new accounts and status of NISA accounts at 10 broker-dealers (five major firms and five internet-based firms) as of February 2024. The number of NISA accounts has increased by approximately 2.9 times compared to the January to March 2023 quarter (average per month) and the amount of purchases increased at the same rate. The purchase amount for the growth quota increased to about 1.5 trillion yen, which is approximately 3.3 times higher than the previous year. A notable point was that in February 2024, nine of the top 10 stock purchases under the growth quota were Japanese stocks. Industry wise, information and communications, banks and pharmaceuticals accounted for more than half of the top 10 stocks. In addition, the number of high-dividend stocks purchased suggests a preference for high shareholder returns and stable management. This inflow is underpinning the market. According to the “2023 Survey on Investment Trusts” conducted by the Japan Investment Trusts Association, the number of investors is expected to rise further as there is growing demand for new NISA accounts (i.e. the growth quota). With the cash and deposit portion of Japan’s personal assets having reached an unparalleled 1,100 trillion yen, demand for shares may be quite significant. Given these circumstances, the Nikkei 225 could reach 43,000 by the end of the year.

*There are two types of savings schemes under the new NISA: the growth quota and accumulative (or installment) quota. Larger fund selection is available in the growth quota, as well as the ability to hand-pick stocks, while the accumulative quota is restricted to broader index funds.

4. Outlook on the Foreign Exchange Market

We continue to believe that the direction of monetary policy will continue to affect the foreign exchange market. The focus will be on additional interest rate hikes in Japan, and the number of rate cuts in the US. After the BOJ’s monetary policy meeting in April, Governor Ueda stated that, “The current yen depreciation is not having a significant impact on underlying inflation” which led the currency to fall to the 160-yen mark at one point. Going forward, due to the opposing direction of monetary policies between the BOJ and the Fed, the dollar-yen rate is expected to remain between 135 to 155 yen until the end of 2024.

5. Risk Factors

The main risk factor is weak personal consumption and the persistence of deflation. Real wages have continued to decline for a record 24 consecutive months. A positive shift in real wages may be hindered by the depreciation of the yen and/or a rise in crude oil prices. The Ministry of Health, Labour and Welfare has reported that total cash earnings have not increased as much as wage increases as announced by the Japanese Trade Union Confederation. Thus until there is an end to the continued restraint on spending, and unless the consumer mindset changes, personal consumption may not recover, which could take us back to an era of deflation.

6. About the Writers

Hiroyuki Ueno, Chief Strategist

Hiroyuki joined SuMi TRUST AM in 2002 and has been Chief Strategist since October 2017.

Through over 20 years of experience working in the investment industry, he is well-versed in the investment management business and has a strong network in the industry as well as among financial authorities.

Hiroyuki’s primary focus is macroeconomy and financial market analysis. His insights based on his own analysis combined with information gathered from his broad network are widely acclaimed.

Hiroyuki is a Certified Member Analyst of the Securities Analysts Association of Japan (CMA).

Katsutoshi Inadome, Senior Strategist

Katsutoshi joined SuMi TRUST AM in February 2023, his primary focuses are market analysis and research, with a particular focus on interest rates, currencies, and fixed income markets.

Katsutoshi has about 18 years’ experience in the financial industry. Before joining SuMi TRUST AM, he was a bond strategist at Mitsubishi UFJ Morgan Stanley Securities, where he was responsible for developing fixed income portfolio management strategies.