1. Japanese Economic Forecast

In 2024, the focus of the Japanese economy will be anchoring inflation. It is expected that the recovery of consumption supported by wage increases, an increase in capital investment, and the recovery of inbound tourism will support inflation. In 2023, personal consumption was restrained due to rising prices, but in 2024, it is anticipated that real wage growth will turn positive. An increase in capital investments such as automation and digital investment, is expected to continue, leading to further improvements in productivity and efficiency. In terms of inbound tourism, not only has it already surpassed the pre-pandemic levels of 2019 in 2023, but per capita consumption has also increased, making it a driving factor in the future growth of the economy.

Regarding capital investment, corporate earnings remain strong thanks to increased prices, the depreciation of the Japanese Yen, and the recovery of inbound consumption. Indeed, the results of the BOJ's short term economic survey announced that capital investment plans in 2023 increased by 13.1% compared with last year. We see that Japanese companies are keen to increase capital investment toward the firm's structural challenges, including labour savings and digitalisation. In addition, export expansion has a positive impact on the capital expenditure in manufacturing firms.

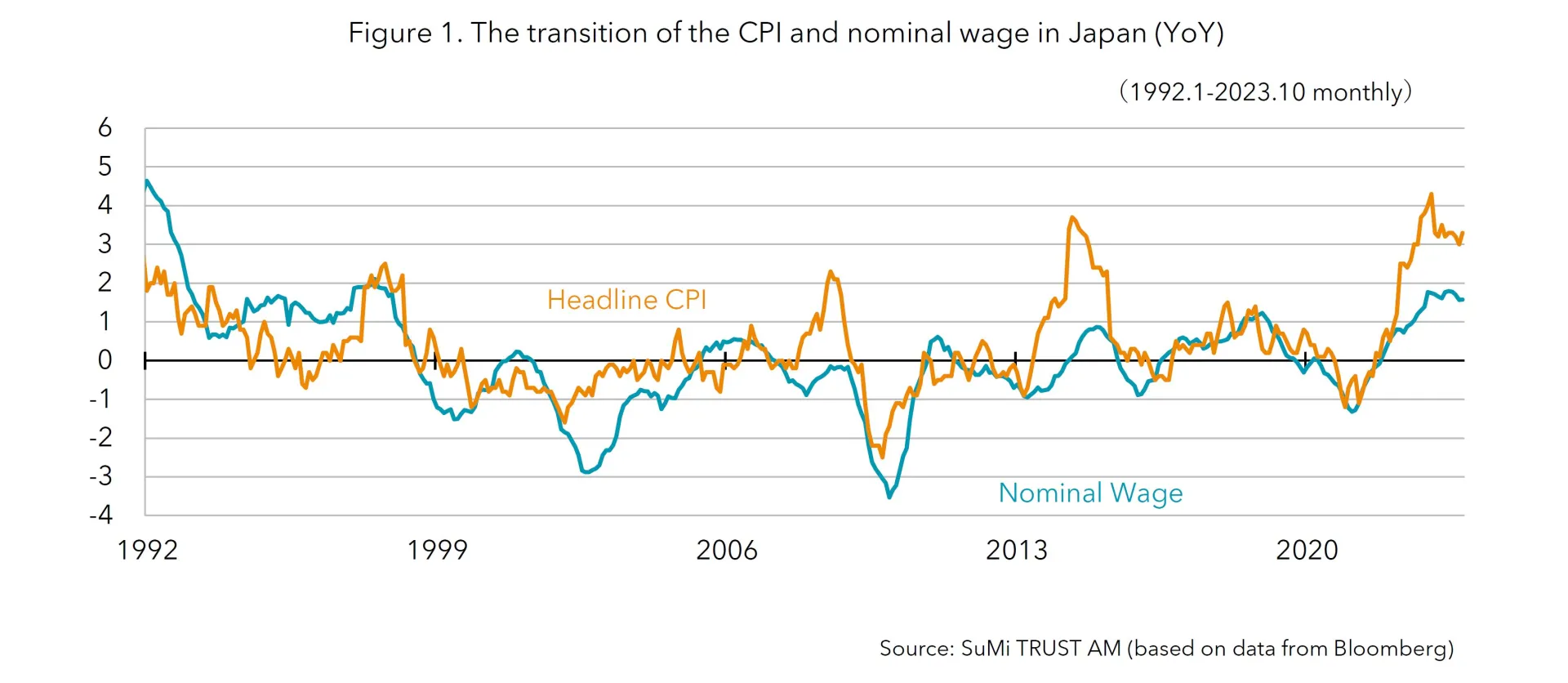

We expect growth in consumer spending in 2024 as real wages increase. In 2023, the outcome of the “Shunto”, the annual negotiation between labour unions and management in various industries, did not exceed the rate of inflation. For 2024, the Japan Federation of Labour Unions urges a 5% wage increase, and a corporate tax cut for the companies that increase wages will encourage companies to do so. In fact, some listed firms have already announced a significant wage increase. We expect that the real wage growth rate will turn positive in 2024 and it will lead to growth in consumer spending.

2. Outlook on Monetary Policy

Market participants will pay more attention to the positive cycle of wages and prices, which the BOJ is focusing on. Currently, there is increasing speculation about the early termination of the BOJ's negative interest rate policy. Governor Ueda's statement in mid-December, mentioning that the period from the year-end to the following year will become more challenging, has further accelerated the speculations. In the December policy meeting, although the monetary policy was left unchanged, there was a strong consensus that the negative interest rate policy will be lifted, and the yield curve control (YCC) policy will be withdrawn in either January or April 2024. Additionally, attention is being focused on the timing of easing interest rates in the United States. In the Federal Open Market Committee (FOMC) meeting held in December, rate hikes were postponed for the third consecutive time. Participants' projections for policy interest rates until the end of 2024 were indicated three times. Given the consideration to avoid excessive yen appreciation and a weak dollar, it is possible to speculate that the BOJ may want to lift the negative interest rates before the US begins cutting rates. After the elimination of negative interest rates there may not be any policy changes for a while to assess the impact on the economy and other factors.

3. Outlook on FX Rate

It is expected that the movement of interest rates will continue to have a significant impact on the foreign exchange market in 2024. Japan's adjustment of policy interest rates and the timing of rate hikes, as well as the United States' timing of policy interest rate cuts, are likely to attract significant attention.

The announcement of the FOMC participants' projection of three interest rate cuts throughout 2024 in December resulted in a significant appreciation of the yen and a weakening of the US dollar. Given the divergence in monetary policy between the BOJ and the Federal Reserve, it is expected that the narrowing interest rate gap may increase upward pressure on the yen. The range we expect in 2024 is 125 to 145. The volatility will remain high in the first half of the year, affected by the monetary policy both in the US and in Japan, and the yen will gradually appreciate to 125 against the US dollar toward the end of the year.

4. Outlook on the Japanese Stock Market

The Japanese stock market in 2024 is expected to be robust, supported by factors such as economic growth due to mild inflation, measures to improve capital efficiency implemented by the government and the stock exchange, and the launch of the new NISA system. There is a rising risk of economic downturn in China, which increases the flow of funds to Japan as an alternative destination in Asia.

Though not the main scenario, there is risk of excessive appreciation of the Japanese yen and a global economic slowdown affected by the increased interest rates.

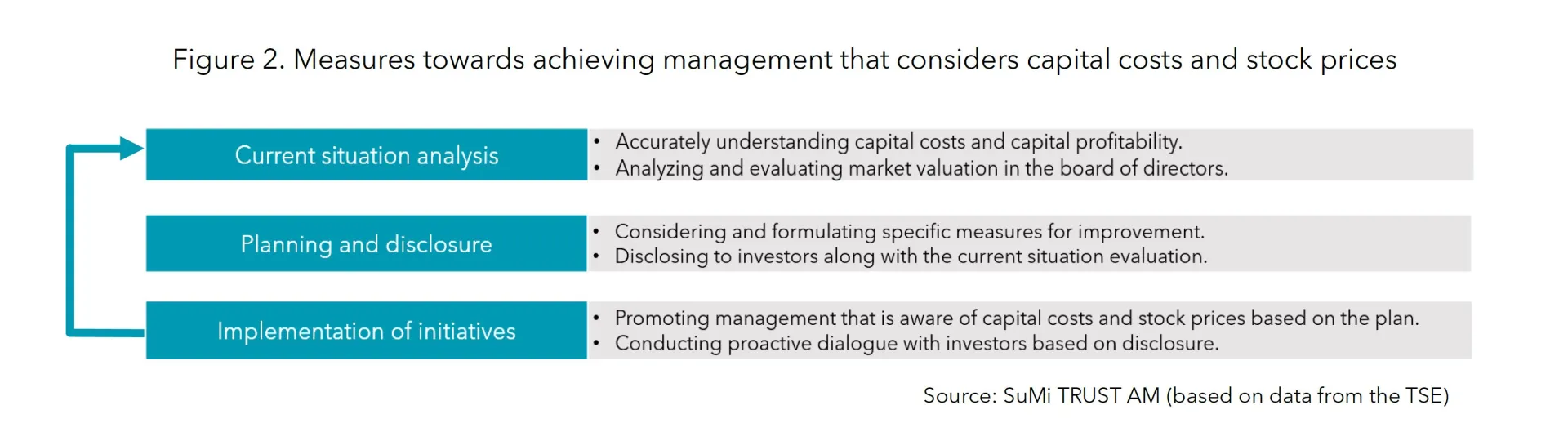

In March 2023, the Tokyo Stock Exchange (TSE) requested listed companies with a low price-to-book ratio (PBR) to disclose and implement improvement measures. The capital efficiency, profitability, and undervalued stock prices of Japanese companies have been pointed out for many years, and in response to this, the TSE has begun to take concrete action. The aim is to enhance the corporate value of listed companies and increase the appeal of the Japanese market. Among the group of companies with a market capitalisation of over 100 billion yen, 45% of companies with a PBR of less than 1 have already demonstrated their intention to respond, and cases of share price increases have also been observed as a result. It is expected that more specific measures will be implemented after the new year, and it is anticipated that these actions will serve as catalysts for stock price support.

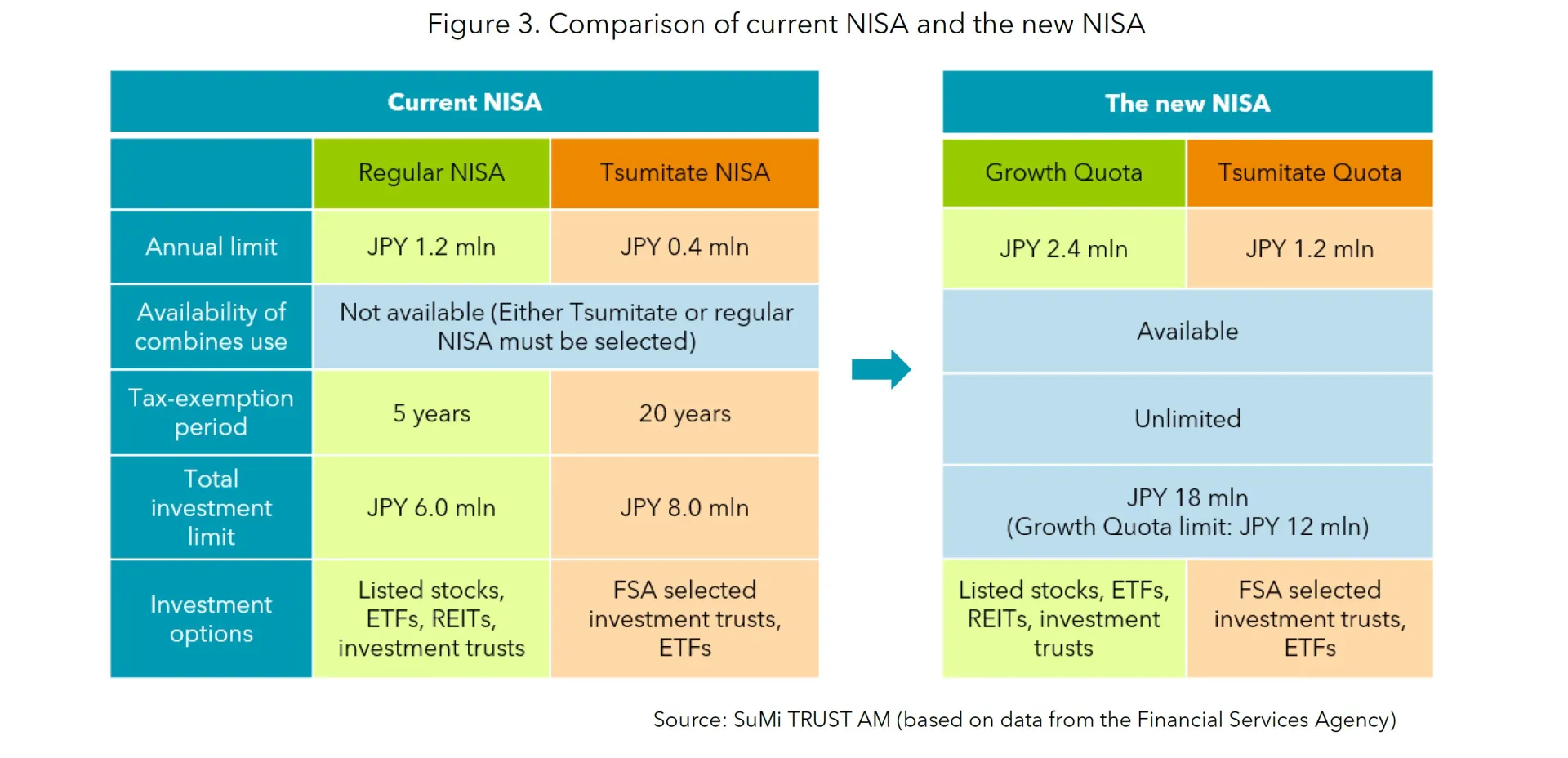

Starting from January 2024, the new NISA system will be launched. It is a new type of tax exemption investment account introduced by the Japanese government to encourage individual investors to save and invest in various financial products. Under the new NISA system, the annual investment limit will be expanded based on whether the type of investment is accumulation (called “Tsumitate”) or growth. The "Accumulation Quota" will increase to 1.2 million yen, three times the current limit, while the "Growth Quota" will be expanded to 2.4 million yen, which is double the current limit of a regular NISA account. In addition to the increased annual investment limits, the total investment limit for the “Growth Quota” account will also be expanded to 12 million yen. When combined with the “Accumulation Quota”, the overall total investment limit will significantly increase to 18 million yen. Moreover, the tax-exemption period will be unlimited under the new NISA system. Regarding the impact of the new NISA system on the stock market, there are various estimates. In the UK, when the system was made permanent in 2008, the number of operational accounts increased about threefold. The Japanese government, in its "Asset Income Doubling Plan" announced in November 2022, aims to double the total number of NISA accounts to 34 million over a period of five years. Estimates for the investment amount range from hundreds of billions to trillions of yen. Considering that Japan's personal financial assets in current deposits amount to 1,100 trillion yen, which is an unprecedented scale globally, it is expected to create a significant buying demand.

Based on these factors, we anticipate that Nikkei 225 will increase to 39,000, updating its historical high, towards the end of the year.

5. Risk Factors

Risks factors include the possibility of worsening conditions in the Chinese economy beyond expectations, prolonged geopolitical risks, and excessive strengthening of the yen. The real estate market in China has not yet fully recovered and remains in a stalemate. While the Chinese government has confirmed its intention to strengthen proactive fiscal policy through measures such as issuing an additional 1 trillion yuan of government bonds and reaffirming this stance at the central economic work conference in December, the specific details are lacking, and this continues to pose risks.

Both the situation in Ukraine and the Middle East show no signs of resolution. If these issues continue, it is expected to result in soaring energy prices, concerns about inflation, and potentially negative impacts on the corporate earnings of Japanese companies due to higher costs. There is a possibility that the exchange rate could temporarily fluctuate significantly in favour of a stronger yen depending on the timing of the BOJ's interest rate hikes and the Federal Reserve's interest rate cuts. If the yen appreciates excessively, it would have a negative impact, particularly on export-oriented companies in Japan.

6. About the Writers

Hiroyuki Ueno, Chief Strategist

Hiroyuki joined SuMi TRUST AM in 2002 and has been Chief Strategist since October 2017.

Through over 20 years of experience working in the investment industry, he is well-versed in the investment management business and has a strong network in the industry as well as among financial authorities.

Hiroyuki’s primary focus is macroeconomy and financial market analysis. His insights based on his own analysis combined with information gathered from his broad network are widely acclaimed.

Hiroyuki is a Certified Member Analyst of the Securities Analysts Association of Japan (CMA).

Katsutoshi Inadome, Chief Manager

Katsutoshi joined SuMi TRUST AM in February 2023, his primary focuses are market analysis and research, with a particular focus on interest rates, currencies, and fixed income markets.

Katsutoshi has about 18 years’ experience in the financial industry. Before joining SuMi TRUST AM, he was a bond strategist at Mitsubishi UFJ Morgan Stanley Securities, where he was responsible for developing fixed income portfolio management strategies.