Coffee Break Column

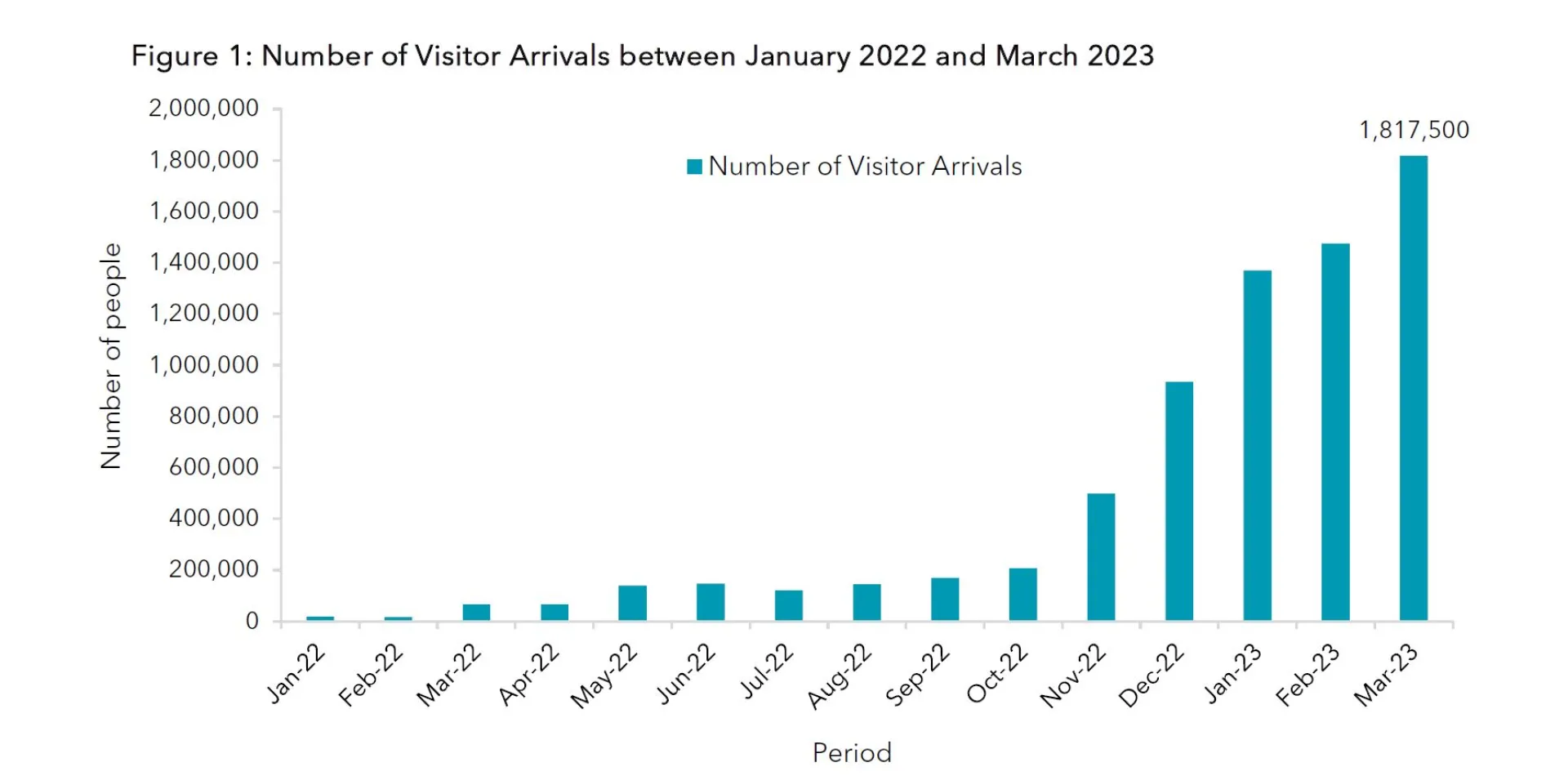

On my visit to Hong Kong last week, I met with investors and in our discussions there was a real sense of consensus on one particular investment idea. The idea was that the tourism industry looks promising because it could be expected to move differently from the economic cycle amid the slowdown in the global economy. In fact, Japan's inbound tourism is gaining momentum. Although the COVID-19 pandemic brought the number of tourists to Japan down to almost zero, the number of foreign visitors to Japan in March was about 1.8 million, 66% of the 2019 level, mainly due to the removal of immigration restrictions. Inbound tourism is now at its highest since the borders opened last October.

Compared to the 31.88 million foreign visitors to Japan in 2019, there is of course still some way to go to reach pre-pandemic levels. However, the increase in travel demand from overseas visitors for this year's summer vacation season will undoubtedly have a positive impact on Japanese companies, and I continue to focus on stocks that will benefit from this resurgence of inbound demand. In response to investors' questions about what specific stocks will benefit from the resumption of such inbound demand, today's column will introduce two stocks that I talked to investors about in Hong Kong.

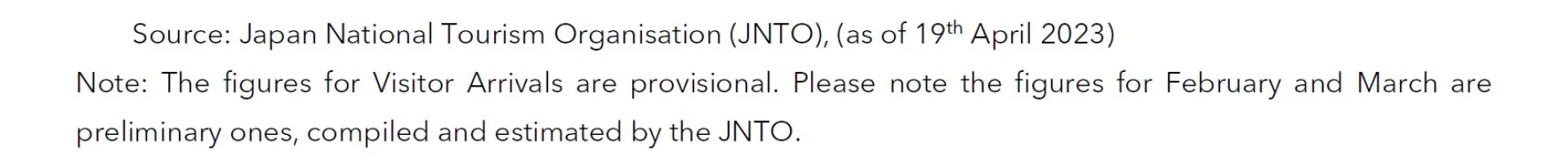

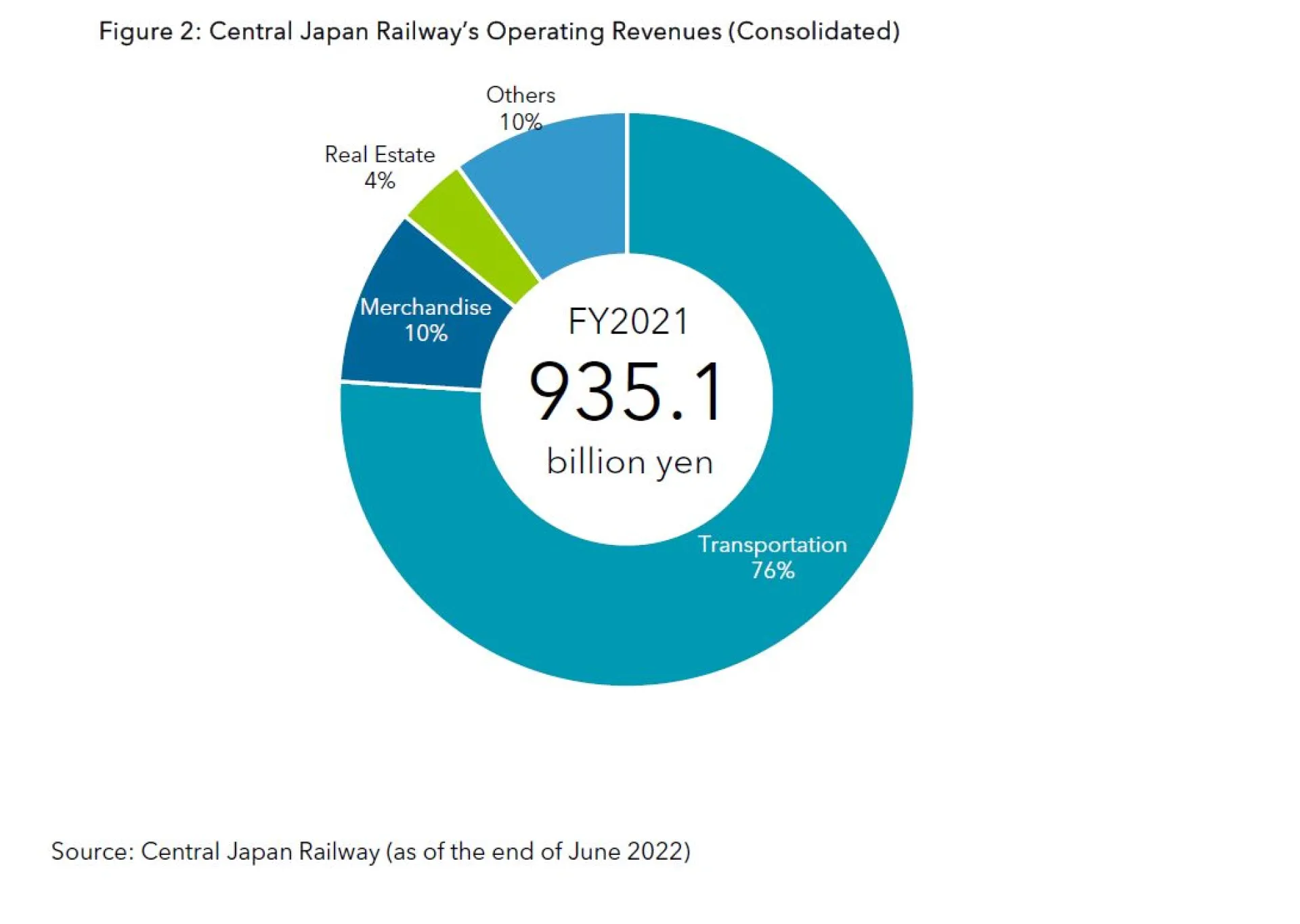

The first is CENTRAL JAPAN RAILWAY, which operates Japan’s high speed rail network known as the Shinkansen or bullet train. Bullet trains have become an indispensable means of transportation in Japan. Demand for bullet trains is expected to increase as economic activity normalises. Over 70% of the company's revenue comes from the Tokaido Shinkansen, which covers the route between Tokyo and Osaka. The remaining is accounted for by the company’s merchandise business, real estate business and others, including its hotel business. The company expects an increase in earnings as the number of Tokaido Shinkansen users recovers against the backdrop of economic normalisation in Japan.

The main types of expected demand for bullet train use due to the normalisation of economic activities can be summarised in the below three ways:

(1) Demand for business trips

(2) Domestic tourism by Japanese citizens

(3) Inbound tourism by overseas visitors

In terms of the order in which demand is recovering, (1) business travel is followed by (2) domestic travel, followed by (3) inbound tourism. Domestic tourism has returned to 70-80% of pre-pandemic levels, and will increase further in line with the baby boomer generation's increased demand for domestic travel. During the pandemic, the baby boomer generation passed the age of 75. Due to their age, it is increasingly difficult to travel abroad, leading to an increase in domestic travel using bullet trains among this group. Inbound tourism, while still in the process of recovery, looks promising as the weaker yen has made it easier for foreign tourists to get to Japan. The majority of foreign tourists arrive in Tokyo, and it is common to visit Kyoto by bullet train from there. Therefore, as overseas travel recovers in the future, demand for bullet train tickets will likely increase.

In addition, CENTRAL JAPAN RAILWAY had been cutting costs during the COVID-19 pandemic. Firstly by promoting online ticket issuing, which was previously handled at the counter, the company successfully reduced its number of counter staff. Another method was to develop a way to inspect the status of trains and vehicles without dismantling the trains. Prior to the pandemic, the trains had to be dismantled to conduct inspections. However, the new and improved inspection method no longer requires the dismantling of trains and is based on the latest review workflows and technological developments.

Next, I will present a company that offers attractive services for travelers. ORIENTAL LAND operates the Tokyo Disneyland and Tokyo DisneySea theme parks, which dominate the Japanese theme park market. They offer Japanese-style hospitality and high quality service. DisneySea is a Japanese original Disney theme park and the only of its kind in the world. They also regularly introduce new attractions that draw in customers, most recently the Beauty and the Beast attraction in 2020.

The characteristics of the company are its (1) high customer attraction rate, (2) many regular visitors and (3) the solid impact from investment. The company is actively investing in enhancing the content of its theme parks, which has produced solid results.

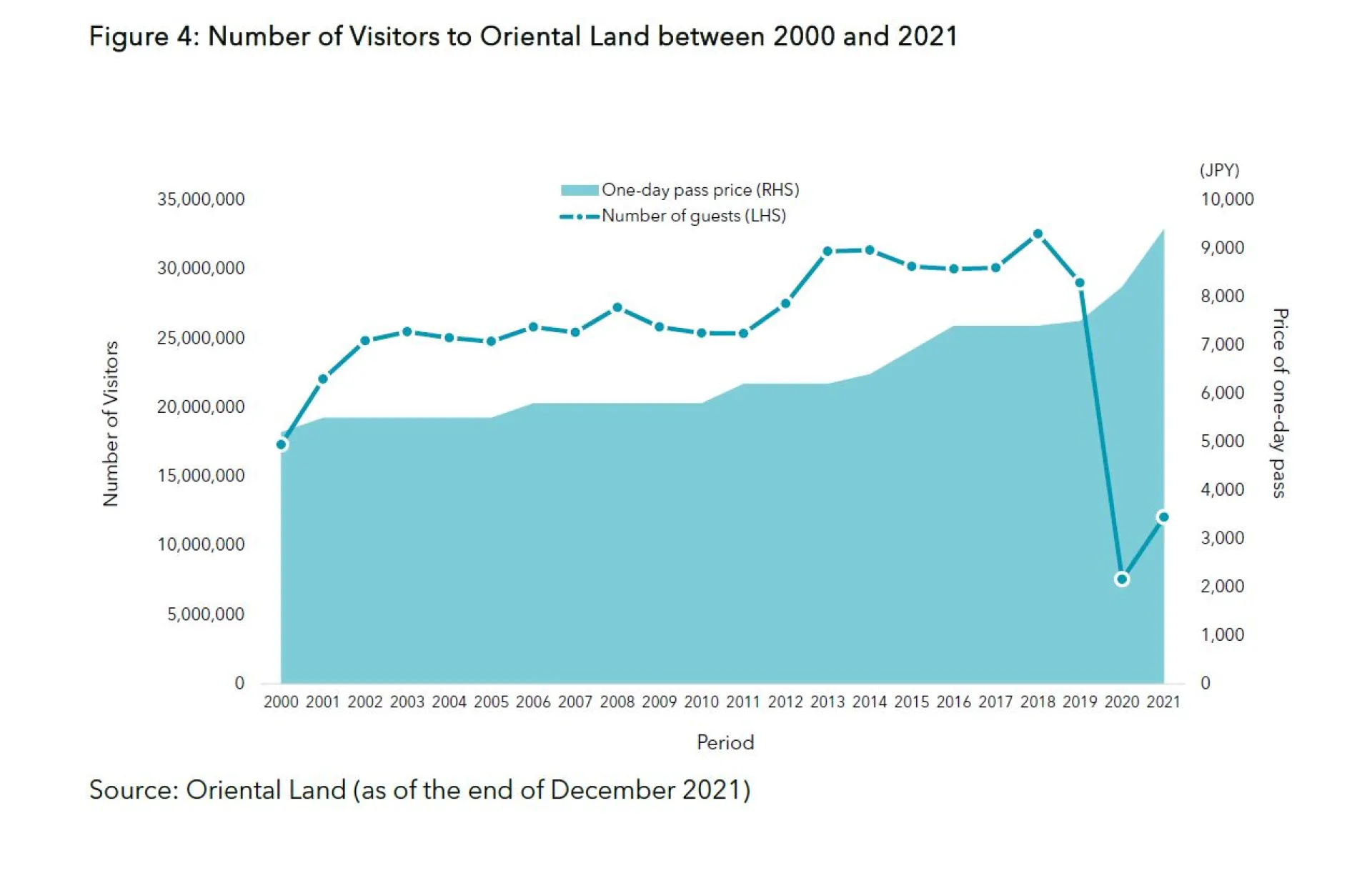

In addition, the company is successfully raising prices whilst raising visitor numbers. If other companies in the same industry were to raise prices in the same way, the number of visitors would likely slow down.

There are two reasons why this has been achieved. One is the high loyalty to the Disney brand. Customers who have been familiar with Disney since childhood tend to go to Disneyland during events such as Halloween and Christmas, even if there is a slight price increase. The second reason is that the price increase has been carefully constructed. Since there is a critical point at which the number of visitors will decrease, the company sets the price one step before that. Conducting precise simulations based on past experience, flexible ticket prices are also provided. For example, by setting discount tickets only for weekdays and evenings, the number of visitors has levelled out.

Domestic demand decreased temporarily during the pandemic, but the number of visitors is increasing as the pandemic finally comes to an end. The number of visitors from foreign countries is still limited, but we hope to see inbound tourism recover to pre-pandemic levels. As for this year, ORIENTAL LAND is launching a commemorative event for the 40th anniversary of the opening of the park, and the company is renewing its daytime parade, which will attract customers. The number of regulars will also increase because of the new excitement this event is anticipated to bring. Inbound revenue was originally around 5% before the pandemic. If inbound tourism returns to pre-pandemic levels, the company’s revenue can expect to receive the 5% benefit back.

In this column, I introduced CENTRAL JAPAN RAILWAY and ORIENTAL LAND. I also believe that stocks such as ISETAN MITSUKOSHI & HOLDINGS and MATSUKIYO COCOKARA, which anticipate an increase in duty-free sales due to a recovery in shopping demand and the weaker yen, look promising. Additionally the hotel industry is showing good prospects due to the significant scope for future increases in accommodation rates, which are lower than those in foreign countries. Tourism-related companies have been cutting costs and improving operational efficiency over the past three years, when the business environment was challenging due to the COVID-19 pandemic. As a result, their break-even point has been lowered, and they will now be more profitable than before if sales increase. We have high expectations for the next fiscal year, which will be marked by an increase in the number of foreign visitors to Japan.