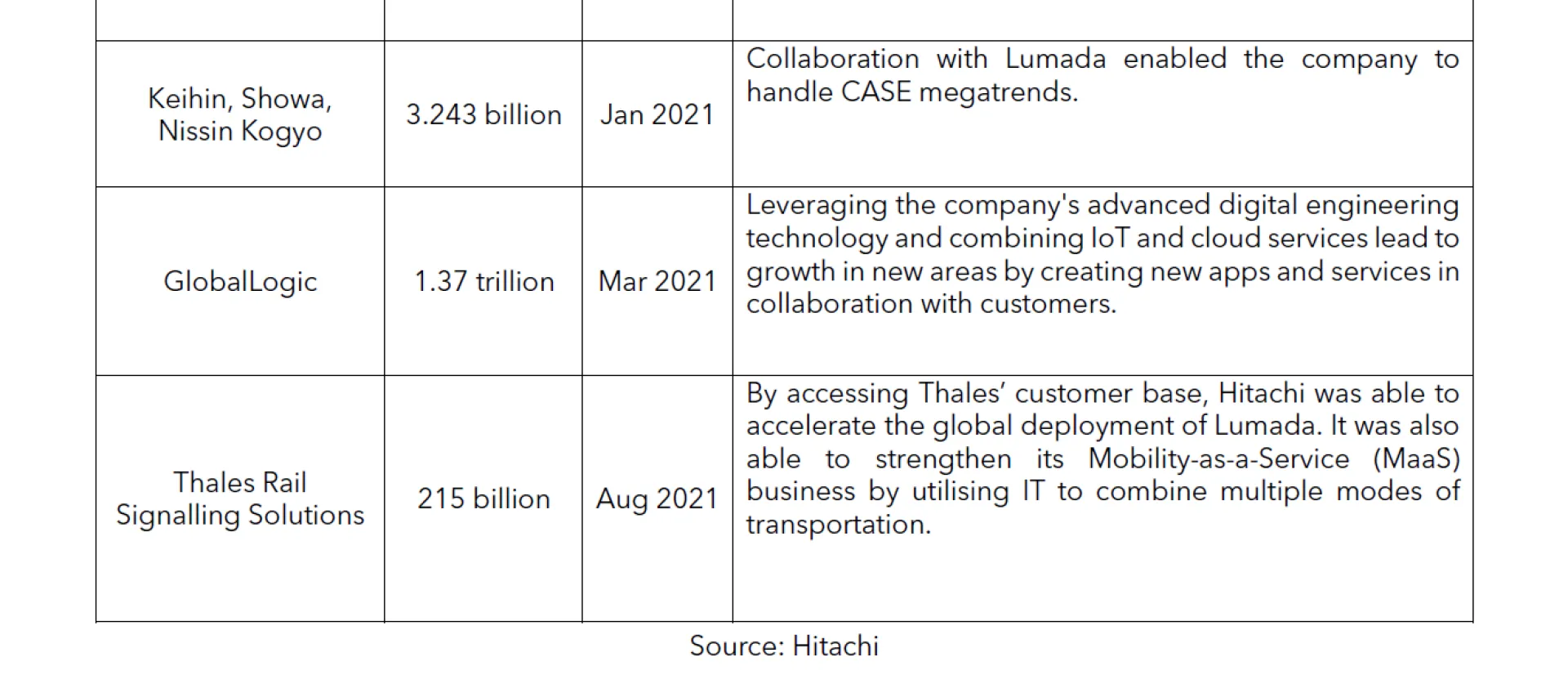

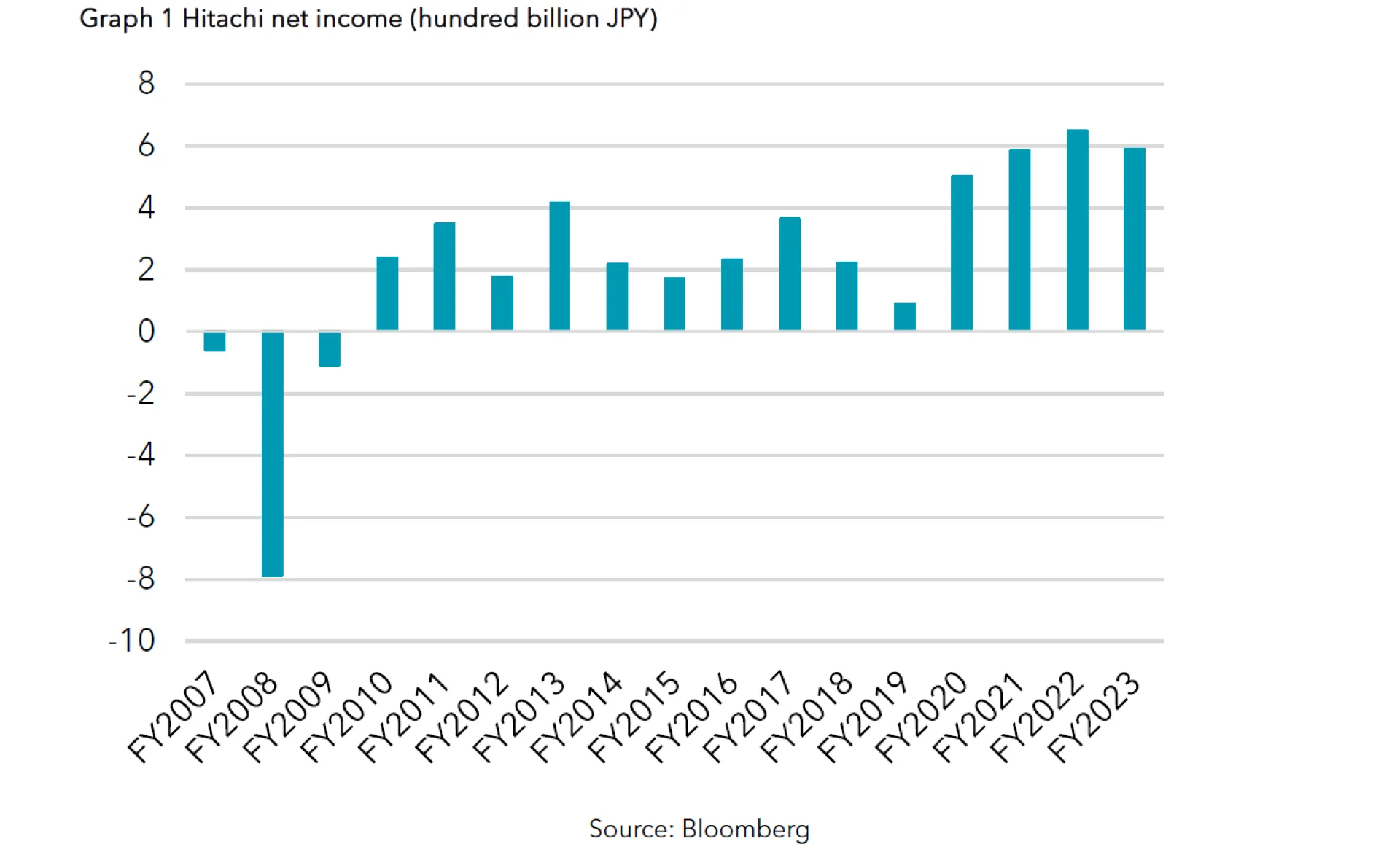

After the 2008 global financial crisis, Hitachi faced management woes. For the fiscal year ending March 2009, the firm posted a net loss of 787.3 billion yen, at the time the largest ever recorded by a Japanese manufacturer. Its survival was in question. Then-President Takashi Kawamura took charge of raising funds for restructuring, initiating a drastic overhaul.

Hitachi consolidated into three areas: Digital, referring to information technology; Green, for power transmission as well as distribution and railways; and Industry, referencing semiconductor manufacturing equipment and industrial machinery. Nominated Chairman and CEO in 2014, Hiroaki Nakanishi made an emblematic sale of the hard disk drive business. Regardless of having been the subsidiary CEO that rebuilt it, his decision was born from the conviction that joining forces with the American rival Western Digital would increase their competitiveness.

It was also unprecedented to exit a profitable business; traditionally, this was not a consideration made by Japanese firms for divisions that were improving performance. Instead, disposals were often reactive and focused on offloading loss-making divisions. But Nakanishi’s approach was for proactive and militantly strategic divestiture that became a key factor in driving such bold structural reform. Without any sacred cows, his unwavering determination was further demonstrated by the sale of publicly listed subsidiaries known as the "Big Three"—Hitachi Chemical, Hitachi Metals, and Hitachi Cable.

The funds generated from sales were partially allocated to share buybacks. For the fiscal year ending March 2024, Hitachi repurchased shares to the tune of 100 billion yen and paid total dividends worth 160 billion yen, resulting in a dividend payout ratio of 45%. The company has expressed its desire to keep the total shareholder return ratio at around 50% of profits.

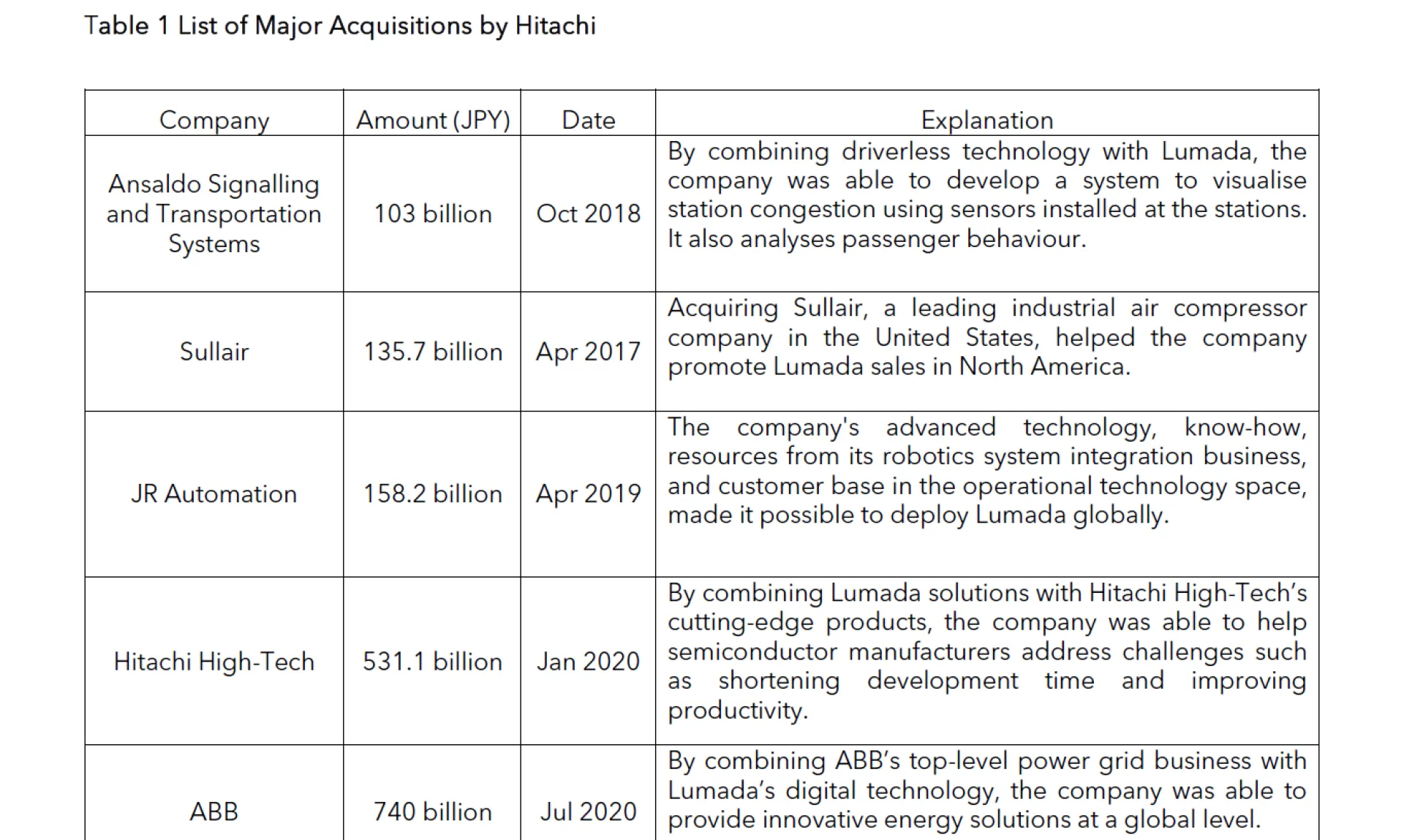

Meanwhile, Hitachi also used the capital from its aggressive selling of misaligned corporate enterprises for titanic acquisitions to overhaul its operations. The acquisition criteria were that new functions would strengthen Lumada, the digital platform christened as its growth engine. ‘Lumada’ is a portmanteau of ‘illuminate’ and ‘data,’ coined to summarise the idea of using data to shine a light on client needs. Instead of simply brokering product equipment, the goal was to enhance profitability by offering packaged software that leveraged data collected from Lumada.

Under this strategy, in 2020 Hitachi invested approximately 750 billion yen to acquire a power grid business from ABB, a major Swiss heavy electric machinery firm with high voltage direct current (HVDC) technology essential for promoting renewable energy by mitigating transmission losses. By combining this global top-tier performer with Lumada's digital technology, there were expectations Hitachi would be able to offer innovative energy solutions at an international scale and would expand across sectors beyond energy including mobility, life, industry, and IT. Then in March 2021 Hitachi announced the acquisition of GlobalLogic, a California-based digital engineering services company, for a total of 9.6 billion USD (approximately 1.036 trillion yen at the time of the announcement). Finally, in August 2021 Hitachi acquired the rail signalling systems division of Thales Group, a major French defines, aerospace, and IT group.

By transitioning from a diversified electrical manufacturer, Hitachi has successfully ridden the wave of the AI revolution, with its market capitalisation increasing fourfold over the past decade. As of the end of 2024 it ranked fourth largest, making it one of the most prominent stocks on the Tokyo Stock Exchange and attracting international investors as a poster child for AI-related equities. Meanwhile, in December of the same year it announced the promotion of Executive Vice President Toshiaki Tokunaga, 57, to President and CEO effective April 1, 2025. In true Hitachi fashion he committed to sustainable corporate growth via further promotion of Lumada and to expanding the search for growth opportunities around the world.

Hitachi's phenomenal recovery can be attributed to improved profitability via meticulously selecting fields of operation, driven by top-down decision-making from successive generations at the helm, combined with lines of business to complement Lumada. Hitachi’s future sustainable growth will depend on whether the company can actualise the Lumada-centric growth strategy, utilising it as a common foundational framework for its IoT initiatives.